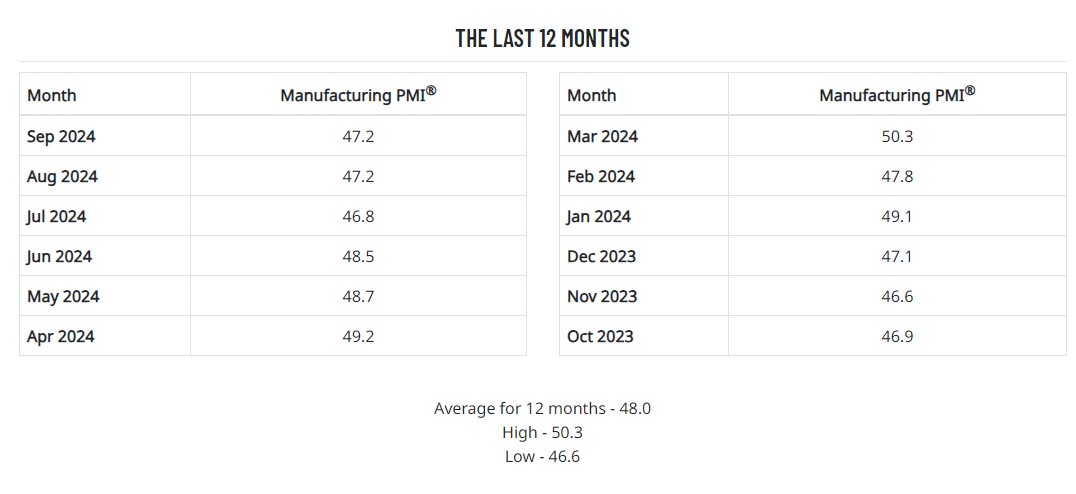

The institute for Supply Management released its monthly manufacturing Purchasing Managers Index (PMI) on Oct. 1 reflecting September activity, which showed flat results following an August increase.

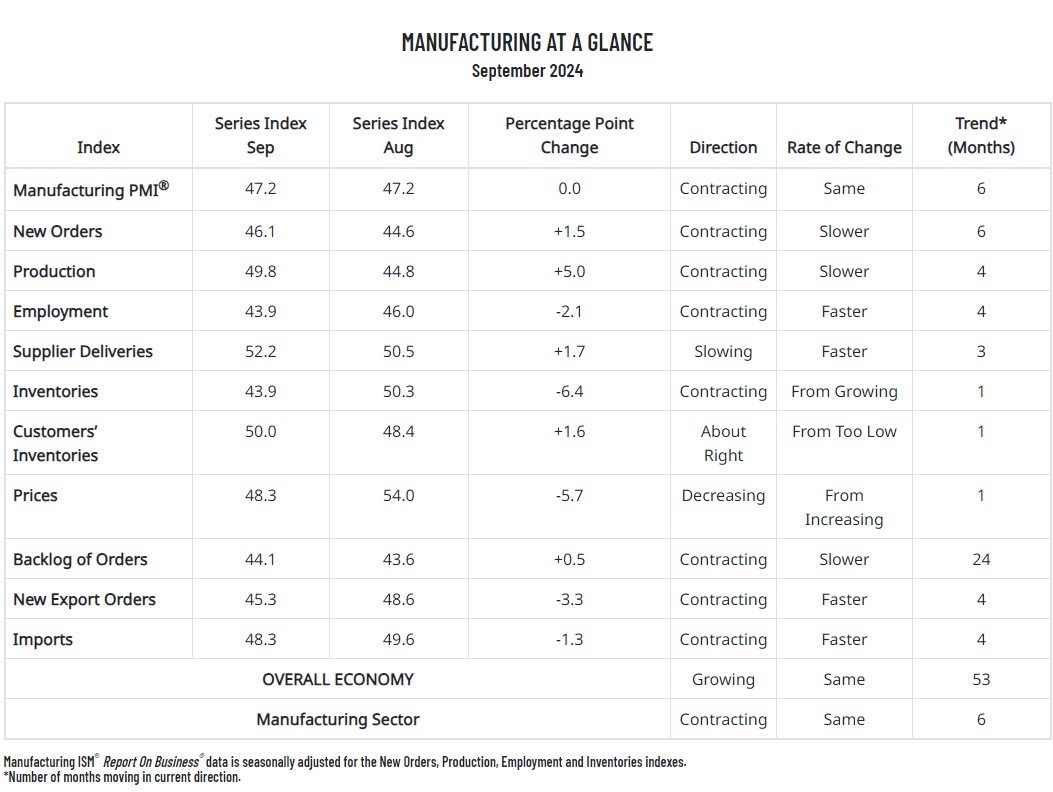

The PMI — regarded as a reliable indicator of overall U.S. industrial economic health — remained flat at the mark of 47.2%, indicating an overall steady economy. The mark signifies that demand continued to be weak, output decline and inputs remained accommodative.

Economists polled by Reuters has forecast a PMI increase to 48.5%.

The September PMI reading indicated contraction (anything below 50.0%) for the sixth consecutive month.

Of the September PMI’s 10 factoring indexes, seven ended the month in contraction territory. The figure was driven down by declines of 6.4 points in inventories, 5.7 in prices and 3.3 in new export orders, offset by increases of 5.0 points in production, 1.7 points in supplier deliveries and 1.6 points in customers’ inventories.

“Demand remains subdued, as companies showed an unwillingness to invest in capital and inventory due to federal monetary policy — which the U.S. Federal Reserve addressed by the time of this report — and election uncertainty,” ISM Manufacturing Business Survey Committee Chairman Timothy Fiore said in the September report. “Production execution stabilized in September. Suppliers continue to have capacity, with lead times improving and shortages reappearing.”

Fiore added that 77% of manufacturing GDP contracted in September, up from 65% in August. He said that the share of sector GDP registering a composite PMI calculation at or below 45% — considered a good barometer of overall manufacturing weakness — was 41% in September, an 8-point jump from August.

The five manufacturing industries reporting growth in September were, in order: Petroleum & Coal Products; Food, Beverage & Tobacco Products; Textile Mills; Furniture & Related Products; and Miscellaneous Manufacturing.

The 12 industries reporting contraction in September were, in order: Printing & Related Support Activities; Plastics & Rubber Products; Wood Products; Apparel, Leather & Allied Products; Primary Metals; Transportation Equipment; Nonmetallic Mineral Products; Electrical Equipment, Appliances & Components; Paper Products; Machinery; Chemical Products; Fabricated Metal Products; and Computer & Electronic Products.

ISM PMI Respondent Commentary

- “North America demand has started to weaken. Asian demand is slightly higher but shows signs of weakness in future months. Comments tied to automotive builds.” [Chemical Products]

- “Global demand continues to remain soft. Fourth-quarter forecasts have been further reduced, with several new programs shifted from 2024 to 2025. Manpower, working capital and supplies are being flexed down in response. The previously anticipated shift from internal combustion engine to electric vehicle (EV) technology has been pushed out due to market response. Long-range plans are being adjusted to incorporate traditional products for longer, while new EV product offerings are being planned for slower rollouts.” [Transportation Equipment]

- “The second half of 2024 is trending upward enough to more than compensate for the year-over-year losses we experienced in the first half. We are anticipating a record sales volume for 2024.” [Food, Beverage & Tobacco Products]

- “The strategy of customer push-outs last year enabled those customers to adapt to the market. Now, while most companies are seeing a slowdown, we are seeing solid growth. The general slowdown in the economy is allowing for prices to continue to stabilize.” [Computer & Electronic Products]

- “A continuing low order rate is resulting in ongoing manufacturing adjustments to balance output with demand.” [Machinery]

- “The fourth quarter is slower than anticipated. We won’t realize the effect of interest rate adjustments with new project starts until the first quarter of 2025.” [Fabricated Metal Products]

- “Business is flat. Waiting for interest rates to drop and the election outcome in November before we confirm our 2025 plans. Currently planning on a flat 2025.” [Furniture & Related Products]

- “Our sales continue to be flat. Our customers are telling us that although our products perform very well, they are forced to seek lower-cost components to maintain their sales.” [Textile Mills]

- “Sales have slowed this quarter compared to the same time period last year. Adjusting production accordingly.” [Miscellaneous Manufacturing]

- “Still hiring to fill vacant positions in production/management. Not adding new jobs. Automotive original equipment manufacturers (OEMs) are starting to slow or cancel orders. The pace is slowing.” [Primary Metals]