The new investors are: Sumitomo Mitsui Banking Corporation, Space Frontiers Fund II (operated by SPARX Asset Management), and Japanet Holdings.

The company says the investment will help scale the manufacturing of its orbital launch vehicle, ZERO, for high-frequency launches.

Space infrastructure

“We recognise that the rocket and satellite communication services being developed by Interstellar are vital components for Japan’s future space infrastructure,” said Tadashi Kito, Head of Space Investment Team, SPARX Asset Management.

“These efforts are aligned with Japan’s Basic Plan on Space Policy and will significantly contribute to the essential positioning and communication infrastructure for next-generation mobility society, such as autonomous driving and smart logistics. We are pleased to support Interstellar’s ambitious challenges and the broader growth of Japan’s space industry through this investment opportunity.”

For its part, Interstellar highlighted its need to expand.

“As we look to expand our rocket and satellite communications businesses globally from our base in Taiki, Hokkaido, working with the best partners is essential,” said Takahiro Inagawa, the company’s CEO, pictured.

“As we look to expand our rocket and satellite communications businesses globally from our base in Taiki, Hokkaido, working with the best partners is essential,” said Takahiro Inagawa, the company’s CEO, pictured.

He also said a business alliance agreement with Sumitomo Mitsui Banking would help the company strengthen supply chains across the space industry.

Interstellar

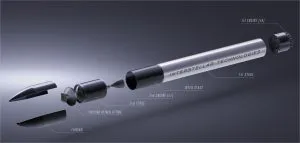

As mentioned, the company is developing its two-stage orbital launch vehicle, ZERO. For LEO, the 32m rocket will carry a maximum payload of 1,000kg.

Interstellar was also selected for Phase 3 of the Ministry of Education, Culture, Sports, Science and Technology’s Small Business Innovation Research (SBIR) programme. It was one of only three companies to pass the first-stage screening.

On the satellite side of its businees, it is developing its own communications satellites. The company says it is is building a vertically integrated model, similar to SpaceX’s approach with Starlink.

Series F

Series F? As opposed to Series A, B or C for relatively early stage funding, Series F typically refers to late-stage funding sought by established companies.

It is often a precursor to an IPO or anticipated acquisition.

The company dates from 2013.

Image: Interstellar

See also: UK and Japan to sign nuclear fusion collaboration deal