TrendForce says that the client SSD market is set to experience strong restocking momentum in 3Q25, following better-than-expected inventory clearance by OEMs and ODMs in the first half of the year.

Several factors are driving this rebound, including the end of Windows 10 support, increased replacement demand spurred by new CPU launches, and surging interest in China’s DeepSeek all-in-one PCs.

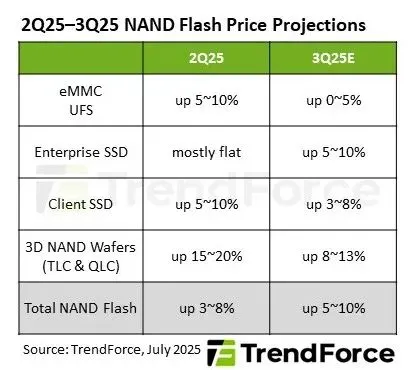

In addition, suppliers are actively promoting high-capacity QLC products, further accelerating shipment volumes. As a result, client SSD contract prices are projected to rise by 3% to 8% in the third quarter.

Shipments of NVIDIA’s Blackwell platform are increasing each quarter, while general-purpose server demand is expanding in North America. Strong order momentum from top-tier Chinese clients is also expected to continue into the second half of the year, further driving enterprise SSD demand.

Enterprise SSD contract prices are projected to climb by 5% to 10% in 3Q25.

eMMC contract prices in 3Q25 are expected to rise by 0% to 5%.

UFS contract prices are forecast to increase by 0% to 5% for the third quarter.

Q3 wafer prices are expected to rise by 8% to 13%.