Infineon expects revenue for the full fiscal year to be around €14.6 billion, slightly down on the prior year. The adjusted gross margin should be at least 40% (previously around 40%) and the profit should now be in the high-teens percentage range (previously in the mid-teens percentage range).

Investments will now total around €2.2 billion (previously €2.3 billion). The Free Cash Flow should now organically amount to around €1.0 billion (previously around €0.9 billion).

Considering the upcoming completion of the acquisition of the Automotive Ethernet business from Marvell Free Cash Flow should reach around negative €1.2 billion.

The Adjusted Free Cash Flow (Free Cash Flow adjusted for investment in frontend buildings and large M&A transactions) should now be around €1.7 billion (previously €1.6 billion).

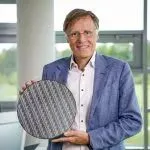

“In the third quarter, Infineon has again achieved solid results in a very volatile environment,” says Jochen Hanebeck (pictured) CEO of Infineon. “Inventory corrections in our target markets have progressed a lot. However, we and our customers are continuing to navigate our way through an uncertain macroeconomic and geopolitical situation. At the same time, we are taking advantage of opportunities in strategic growth areas: software-defined vehicles – strengthened by our upcoming acquisition of Marvell’s Automotive Ethernet business – power supply solutions for AI data centers, rapidly increasing investment in energy infrastructure, as well as, going forward, humanoid robots. In these areas, semiconductor demand is increasing in the long term. Infineon, with its portfolio encompassing power semiconductors, analog & sensors, as well as control & connectivity, is ideally positioned to play a role in shaping these markets”

volatile environment,” says Jochen Hanebeck (pictured) CEO of Infineon. “Inventory corrections in our target markets have progressed a lot. However, we and our customers are continuing to navigate our way through an uncertain macroeconomic and geopolitical situation. At the same time, we are taking advantage of opportunities in strategic growth areas: software-defined vehicles – strengthened by our upcoming acquisition of Marvell’s Automotive Ethernet business – power supply solutions for AI data centers, rapidly increasing investment in energy infrastructure, as well as, going forward, humanoid robots. In these areas, semiconductor demand is increasing in the long term. Infineon, with its portfolio encompassing power semiconductors, analog & sensors, as well as control & connectivity, is ideally positioned to play a role in shaping these markets”