Increased competition from HONOR has eaten into Samsung’s near monopoly of the book-type foldables segment.

Samsung is fighting back and has closed the technical gap on the competition with the Galaxy Z Fold7, its thinnest, lightest and most powerful foldable to date.

But HONOR looks set to regain the technical crown with the European launch of the HONOR Magic V5 on August 28.

The competition is expected to intensify in 2026 with the expected entry of Apple into the foldable smartphone market.

By 2028, book-type foldable smartphone sales are projected to surpass 2% of Europe’s total smartphone sales and reach almost 10% of the premium smartphone segment.

For Europe’s foldable smartphone market, 2024 was a pivotal year. While still a relatively small segment – accounting for around 2% of the continent’s total smartphone sales – foldable smartphone sales increased 37% YoY in 2024.

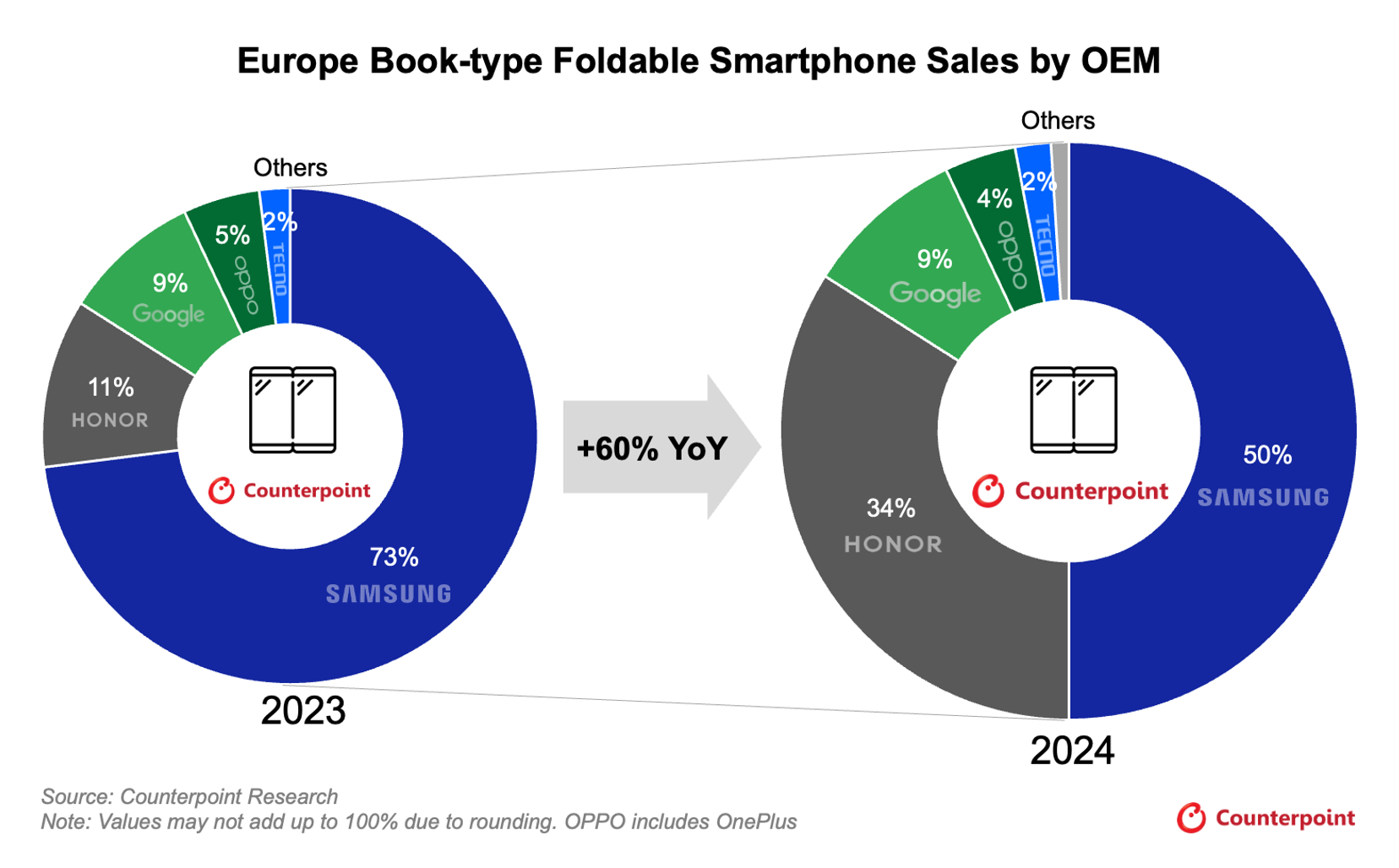

The main driver here was the book-type form factor, for which sales increased 60% YoY. Nevertheless, book-type foldables still only account for less than 1% of the total market, with consumer concerns around price, durability and use cases.

One of the key reasons for the growth in 2024 was the increase in competition. Previously, with its early entry into the segment and its market-leading position in the region’s overall smartphone sales, Samsung enjoyed a near monopoly in the foldables market.

In 2022, Samsung accounted for 98% of book-type foldable smartphone sales in Europe. But by the end of 2023, Samsung’s share had shrunk to 73% as HONOR fought back with the Magic Vs, and other OEMs like Google, OnePlus and TECNO entered the market with book-type devices of their own, including the Pixel Fold, Open and Phantom V Fold, respectively.

This trend continued in 2024 as many OEMs launched updated versions of their foldables. But the largest impact was made by HONOR.

HONOR followed up its Magic V2, which accounted for 27% of book-type foldable sales in Europe in 2024, with the Magic V3, a giant leap forward in hardware. The V3 was the thinnest and most durable book-type foldable to date, and featured market-leading camera and battery technologies.

The Magic V2 and V3 helped HONOR become the fastest-growing book-type foldable OEM in Europe in 2024, with sales increasing 377% YoY and share tripling to 34%.

Other OEMs also upped their game, like with the Google Pixel 9 Pro Fold and TECNO Phantom V Fold 2. Although it was still leading the market, the future looked ominous for Samsung, as it was seemingly struggling to make any major improvements to its Galaxy Fold range. But it looks like that is about to change.

Europe Book-Type Foldable Smartphone Sales by OEM

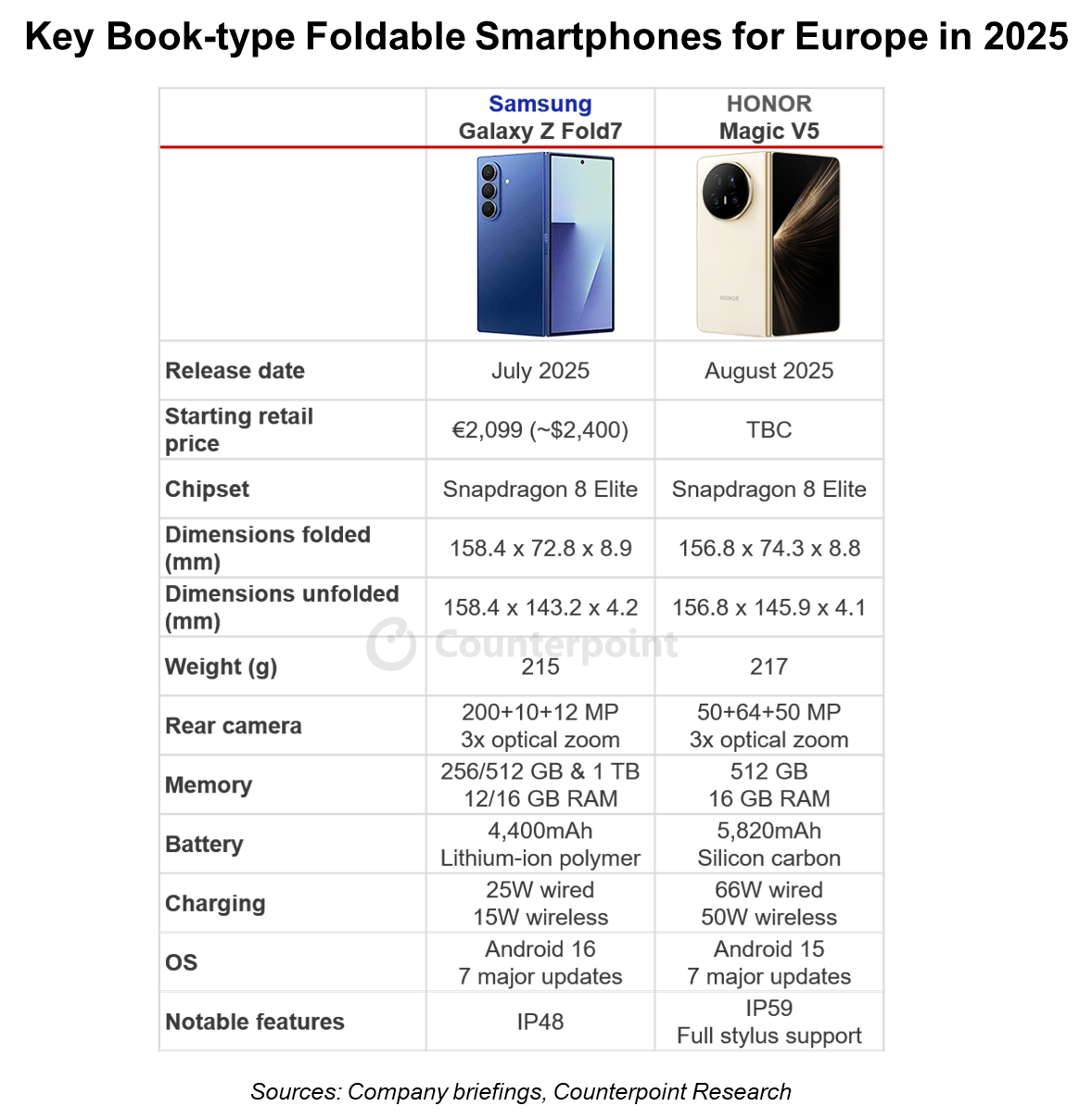

In July 2025, Samsung launched the Galaxy Z Fold7, its thinnest, lightest and most powerful foldable to date. After years of iterative upgrades, the Fold7 is a major step forward, and Samsung has finally closed the gap on the competition.

At 4.2 mm thickness when unfolded and weighing 215 gm, the Fold7 is the thinnest and lightest book-type foldable available in Europe (at the time of writing). And with its improved camera module and advanced Galaxy AI features, we expect the Galaxy Z Fold7 to be Samsung’s most popular book-type foldable to date.

But HONOR has not been sitting idle, and looks set to regain the technical crown with its best foldable to date. HONOR launched the Magic V5 in China in July and will release it in Europe on August 28. At 4.1 mm thick, the Magic V5 will retake the bragging rights for the thinnest book-type foldable in Europe.

It also has a 5,820 mAh battery (which dwarfs the Fold7’s 4,400 mAh one and charges much faster too), IP59 rating (compared to the Fold7’s IP48) and a Super Steel Hinge (HONOR’s strongest and most advanced hinge, which is likely to be more durable).

Google is also slated to launch its latest foldable towards the end of August.

Key Book-type Foldable Smartphones for Europe in 2025.

Apple is expected to introduce a book-type foldable in 2026, initially in its most important markets like North America, China, Japan and Western Europe, and then expanding into other regions during 2027-2028.

With a large, loyal and high-end user base, Counterpoint expects relatively fast adoption in Europe’s big ultra-premium markets like the UK and Germany, which will likely provide a shot in the arm for the European foldables market.

Increased competition is usually a good thing, as it drives innovation and pushes down prices. And while we don’t think mass-market adoption will happen any time soon, we do expect foldables to take an increasingly larger share of the premium segment from next year.

Foldable sales dropped in the first half of 2025 as innovation seemingly stagnated and as wider macro conditions impacted overall, especially premium, smartphone sales.

But as outlined above, Counterpoint expects that to change in the second half, and accelerate in 2026. By 2028, book-type foldable smartphone sales are expected to reach almost 4 million a year, surpassing 2% of total smartphone sales.

Counterpoint projects foldable smartphones to reach almost 10% of sales in Europe’s premium smartphone segment ($800 and above), and potentially even higher in key markets like the UK and Germany.