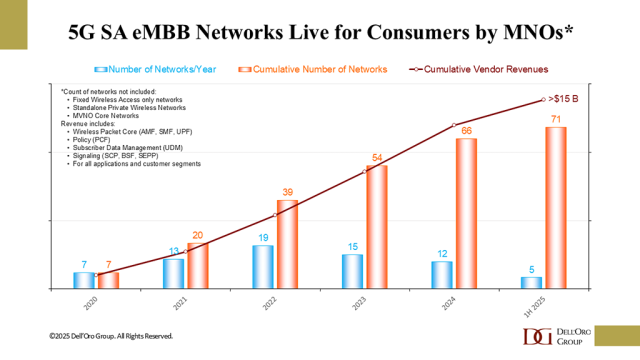

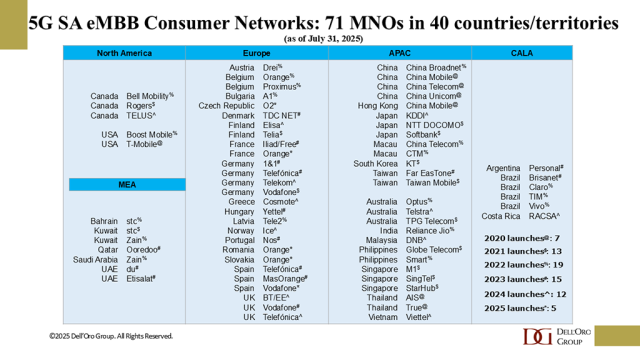

“With the strong growth we have now seen in the first two quarters of the year, we are doubling the growth rate for 2025 to 10 percent Y/Y,” says Dell’Oro’s Dave Bolan, “factors contributing to the growth of 5G MCNs are increasing 5G Standalone (5G SA) subscribers and more 5G SA launches by mobile network operators (MNOs). We have identified 71 MNOs that have launched 5G SA service for consumers, including five launches to date in 2025. Other MNOs have 5G SA networks on the drawing board that will be coming to market over the next several years.”

“As 5G SA networks continue to mature, we see more 5G SA elements coming to market, such as new radio (NR), reduced capability (RedCap), and network slicing,” adds Bolan, “ NR RedCap reduces the cost and complexity of 5G SA IoT devices, which will add to the uptick of devices connecting to 5G mobile core network, such as smartwatches and AR glasses. Dynamic network slicing provides on-demand performance as needed by users, such as at a given venue or wireless broadcasters. Static network slicing is being used for fixed wireless access and mission-critical services that require full-time performance enhancements.”

“At the same time, we see MNOs realizing the potential of their 5G SA cloud-native network. MNOs are beginning to upgrade their voice cores to cloud-native IMS cores, fueling the growth of the Voice Core market,” concludes Bolan, “meanwhile, if the upgrade is for Voice over NR (VoNR), it also adds additional fuel to the 5G Mobile Core growth.”

“As an industry, we have been bemoaning the slow uptake of 5G SA networks by MNOs,” Bolan continues, ‘after all, we are in the sixth year of the 5G SA era, and with over 700 MNOs in the world, it is surprising that more 5G SA networks have not launched.”

So why the acceleration in the 5G SA core space despite only 10% of the MNOs having launched 5G SA?

First, let’s look at the MNOs that have launched 5G SA eMMB networks for consumers.

The 40 countries/territories, with at least one MNO, can provide service to over 55% of the world’s population. At the same time, only 14% of the world’s mobile subscribers had 5G SA services at the end of 2024 (per Ericsson Mobility Report, June 2025). The conclusion one can draw from this is a low penetration rate of 5G SA subscribers from the 71 MNOs offering 5G SA services.

The Chinese MNOs have been very aggressive in building out 5G SA coverage, and China Mobile, as an example, has achieved 60% 5G SA subscriber penetration after their launch in 2020. China Mobile’s 5G SA penetration rate is the best-case scenario for a large Tier-1 MNO.

But even so, they still have many subscribers who can migrate from 4G to 5G. As the existing 5G SA networks mature in coverage and new, lower-cost handsets become available, with attractive incentives by MNOs to upgrade to 5G SA handsets, subscriber growth is certainly driving demand for more capacity in the 5G Core.

In addition, many MNOs already offer 5G SA for enterprises and Fixed Wireless Access (FWA), but have not yet opened the 5G SA network to consumers; however, they are expected to do so soon. They include Bharti Airtel in India, 3 in Ireland, Sunrise in Switzerland, and AT&T and Verizon in the US.

Other MNOs have announced plans to launch 5G SA, but without specific timelines, including Bouygues Telecom, O2 Telefónica, and SFR in France, Bharti Airtel in India, MTN in Nigeria and South Africa, Rakuten in Japan, and Vodacom in South Africa, which will drive future growth. As a result, 5G MCN revenue will is forecast to grow at a 6% CAGR from 2024 to 2029.

NR Reduced Capability (RedCap): RedCap-enabled IoT will bring more 5G devices to market at a lower cost point with better performance, like new 5G smartwatches expected to be introduced in the fall. AT&T has announced nationwide RedCap coverage, maybe in anticipation of a new 5G smartwatch by Apple.

Rumours of 5G smartwatches with RedCap coming this fall and winter are rampant for all smartwatch suppliers. These new smartwatches will require more capacity for the 5G Core. Even if these rumors do not materialize in this upgrade cycle, AT&T can offer more 5G SA services to enterprises using new IoT devices with RedCap.

5G MEC: One example of Public MEC is Telefónica Spain, which is in the process of implementing 17 MEC nodes, delivering a latency of 10 ms to MEC subscribers by the end of 2025. Private MEC nodes are numerous (on-premises) with over 55,000 in China.

The China market penetration rate is approximately 25% of enterprises, and Chinese MNOs are planning to address the next 25% of enterprises over the next several years. Also, Dynamic network slicing is maturing, and MNOs, such as Orange in Europe, are promoting these capabilities in their 5G SA markets.

Voice over NR (VoNR): As 5G SA continues to mature, MNOs are beginning to leverage more of the capability that 5G SA offers, for example: VoNR with cloud-native IMS Core is bringing immersive calling experiences to the user, driving Voice Core and 5G Packet Core growth. MNOs such as AT&T and Boost Mobile in the US, O2 Telefónica in Germany, and 2degrees in New Zealand are in the process of upgrading their Voice Core networks to IMS Core cloud-native network functions.

Impact of AI: Theoretically, Agentic AI apps can be connected to the network 24/7, which could significantly impact network performance, driving the demand for more packet core and voice core capacity. Examples of agentic AI are emerging as mobile network operators (MNOs) begin offering premium versions of advanced AI search tools to their customers.

For instance, Bell in Canada and SoftBank in Japan have partnered with Perplexity to attract new customers to their networks. Additionally, a growing number of existing customers are utilizing AI independently.

Public Cloud: Another trend is the re-emergence of the option to put the 5G Core workloads in a Public Cloud. Public Cloud vendors are returning to the market with better solutions than several years ago, when we were in the hype phase about moving 5G workloads to the Public Cloud. MNOs can now evaluate which is the best approach for their market, build a 5G Telco Cloud, use the Public Cloud, or go with a Hybrid Cloud strategy.

Increasing 5G subscriber growth, additional 5G SA buildouts, more devices via RedCap, better performance via MEC with dynamic network slicing attracting new customers, greater use of Agentic AI, and more use of the Public Cloud are behind the driving growth for 5G SA networks.

Multi-access Edge Computing (MEC), a sub-segment of the 5G Packet Core, was up 32 percent Y/Y for 2Q 2025, and is projected to be up 44 percent Y/Y for 2025.

For 2Q 2025, the vendor rankings were:

-

- Worldwide: Huawei, Ericsson, Nokia, and ZTE

- Worldwide, excluding China: Huawei, Ericsson, Nokia, and ZTE.