The electronic components distribution industry body represents approximately 85% of the European components DTAM.

DMASS said that European semiconductor distribution sales in Q2 2025 fell 14% compared to Q2 2024. Austria experiencing the steepest drop (36.6%) followed by France (20%), Germany and Ireland both experienced a fall of 17% but the UK fell 10.6% in the period. Iberia alone saw an increase (2.4%). The total European semiconductor market value is €2.220.00 at Q2 2025.

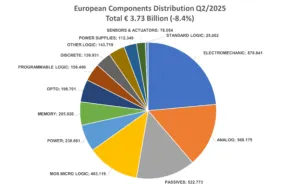

Power and programmable logic distribution sales were hit hardest in this period, both seeing a decline of 21%. MOS micro logic, analogue and memory sales also shrank by 19%, 15% and 13% respectively. Opto also fell by 6% while sensors and actuators rose by 6% and discrete distribution sales also rose (+1.6%).

The interconnect, passive and electromechanical components (IP&E) rose overall by 1.43% and is worth €1.51bn but Austria, UK, Germany and Switzerland saw falls of 7%, 3%, 4%, and 6% respectively.

In this market, the standout category was circular connectors with an increase of 122.7%. Power supplies also rose by nearly 7%, electromechanical components by 2.3% and sensors increased by 7.6% compared to Q2 2024. The largest decline was in the capacitor market, film capacitors fell nearly 18%, tantalum capacitors dropped 11% and aluminium capacitors declined 10.5%.

DMASS chairman Hermann Reiter said that whiel the European economy remains resilient it faces “increasing pressure from geopolitical tensions and gloabl trade distruptions”. He said extended lead times, inventory volatility and dependence on critical raw materials from Asia all contributed to strains in the supply chain.

He also identified differences in the international market. “While the electronic components supply chain remains global in scope, customer markets are fragmenting rapidly — with AI demand surging in Asia and the US, Europe faces industrial stagnation and must redefine its position to offset a declining automotive sector.”

“Europe is responding with nearshoring strategies, supply chain diversification, and digital transparency measures. The rising demand for semiconductors, IoT devices, and AI applications continues to drive innovation, presenting growth opportunities even amid uncertainty. To remain competitive, Europe must more actively shape these global dynamics in a rapidly evolving electronics landscape,” he said.

Anglia: ‘Lead times likely to move out rapidly’ as market picks up