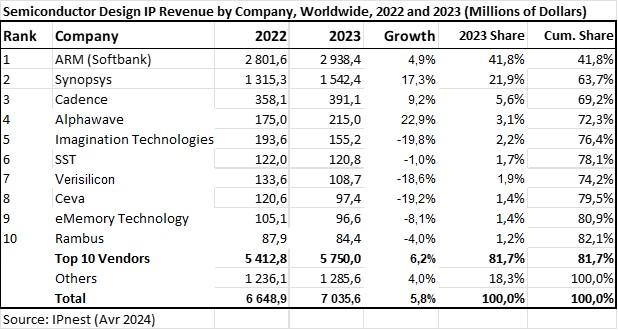

Last year, IP licensing fees grew 14% and royalties fell by 6%.

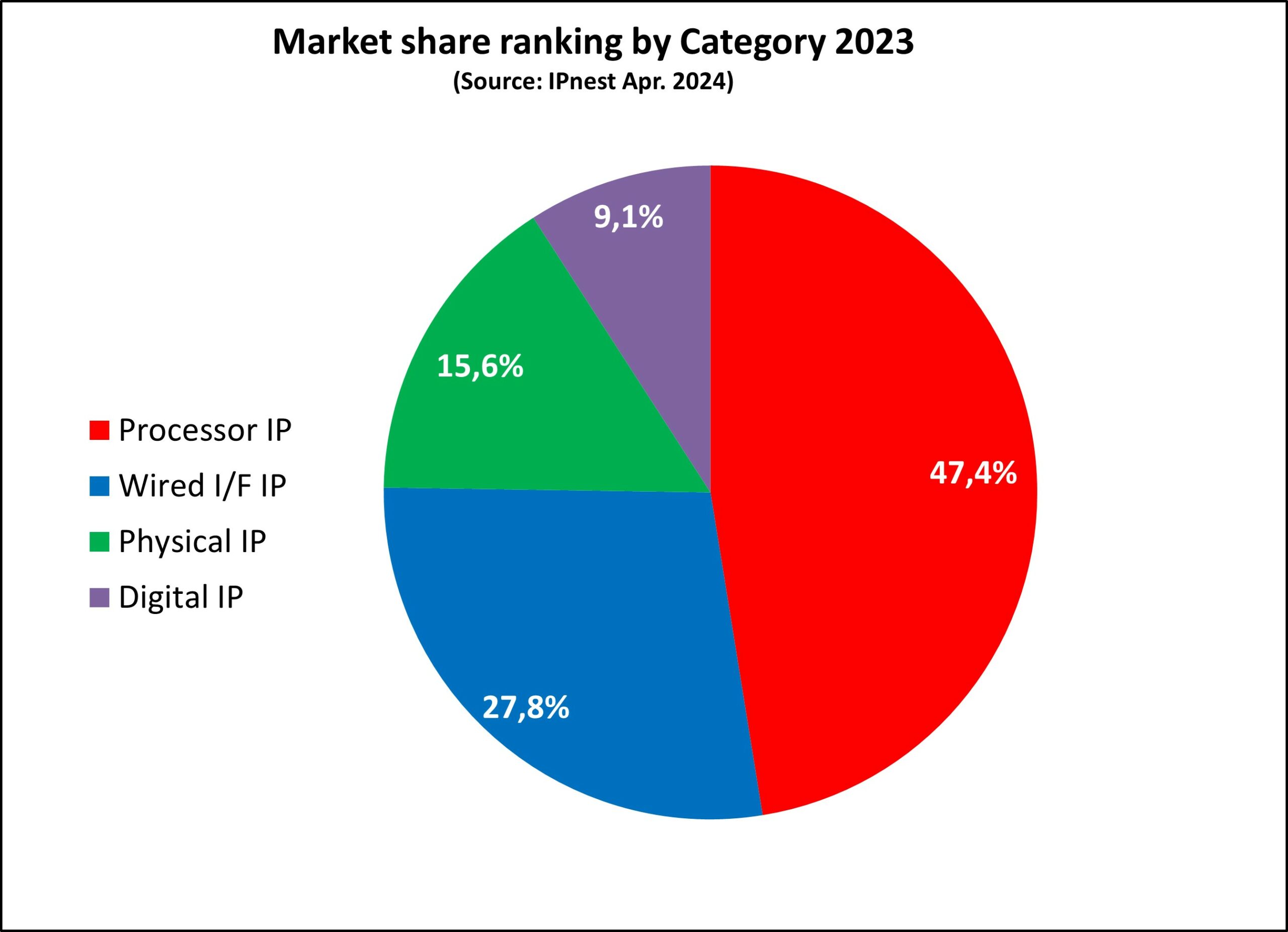

Processor (CPU, DSP, GPU & ISP) slightly growing by 3.4%.

Physical (SRAM Memory Compiler, Flash Memory Compiler, Library and I/O, AMS, Wireless Interface) slightly decreasing (-1.4%)

Digital (System, Security and Misc. Digital) was slightly growing by 4%.

Wired Interface is still driving Design IP growth with 16% to reach almost $2 billion in 2023 (after growth in the 20% during 2022, 2021 and 2020).

Among the Top Ten, IP vendors targeting consumer applications, like smartphone, had decreasing revenues, when those targeting interface IP products and targeting HPC and AI were growing.

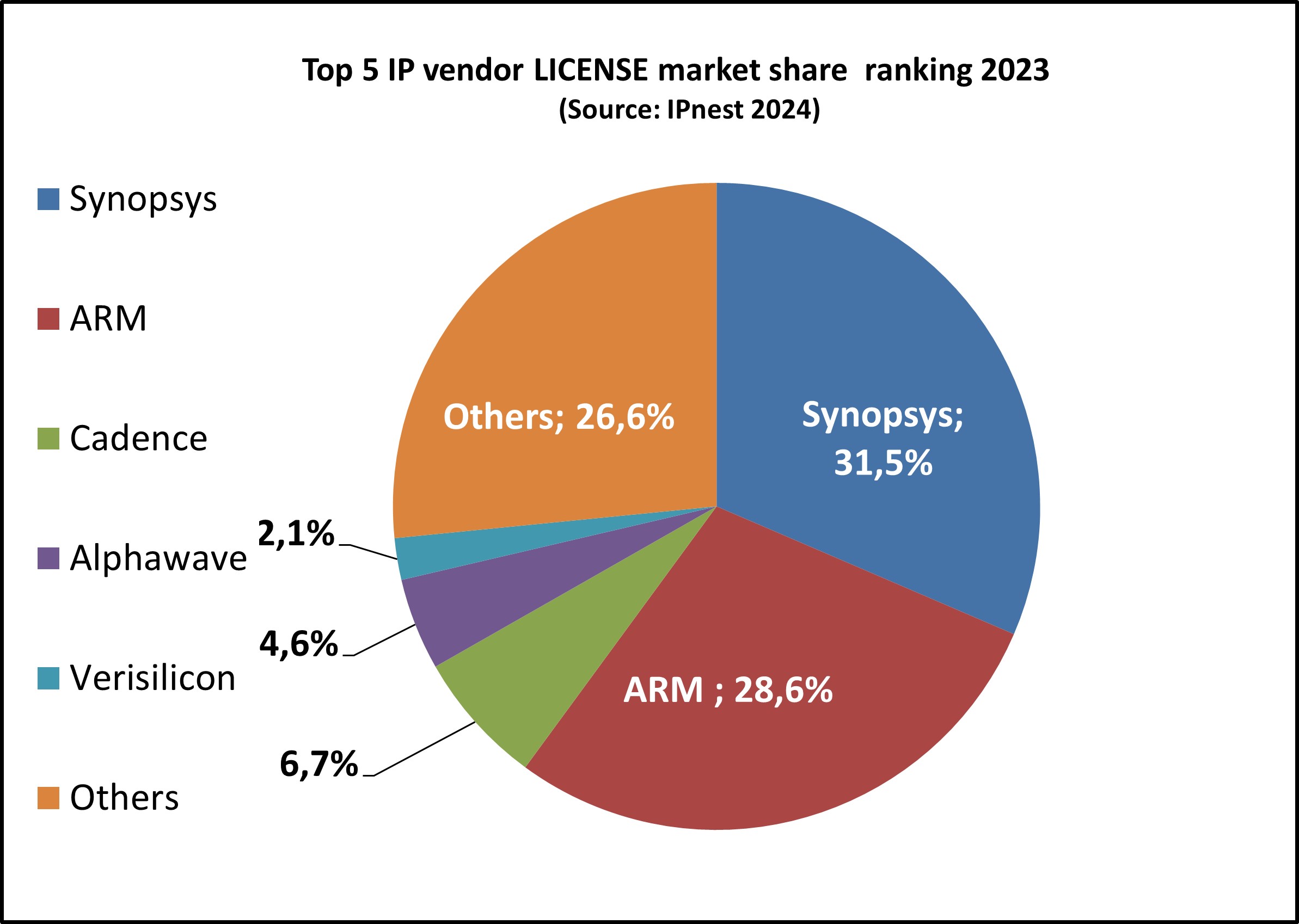

There is one exception – ARM is moderately growing by 5%. In fact, ARM has compensated declining royalty revenues dues to smartphone weakness by a remarkable performance in license revenues growing by 28.6%.

After years spent in following phantom IoT market, ARM has realized in 2023 that the real source of growth (and profit) was with HPC and AI, and in a certain extent Automotive to eventually improve their positioning and portfolio.

Also to be noticed is a strong increase at the end of 2023 from “revenues from related parties”, we can translate by “ARM China”…

If we look at the #2, #3 and #4, Synopsys, Cadence and Alphawave, the last is 100% focused on Interconnect IP when for Synopsys it’s 71%, and both are strongly growing (by 23% and 17% respectively) when Cadence growth is moderate with 9%.

Ceva and Rambus are both declining, in both cases they have re-engineered their portfolio, and stopped supporting product line (Ceva) or sold it, like Rambus did with Interface PHY IP to Cadence.

Synopsys, Alphawave and Cadence growth confirm the importance of the wired interface IP category aligned with the data-centric application, hyper scalar, datacenter, networking or IA.

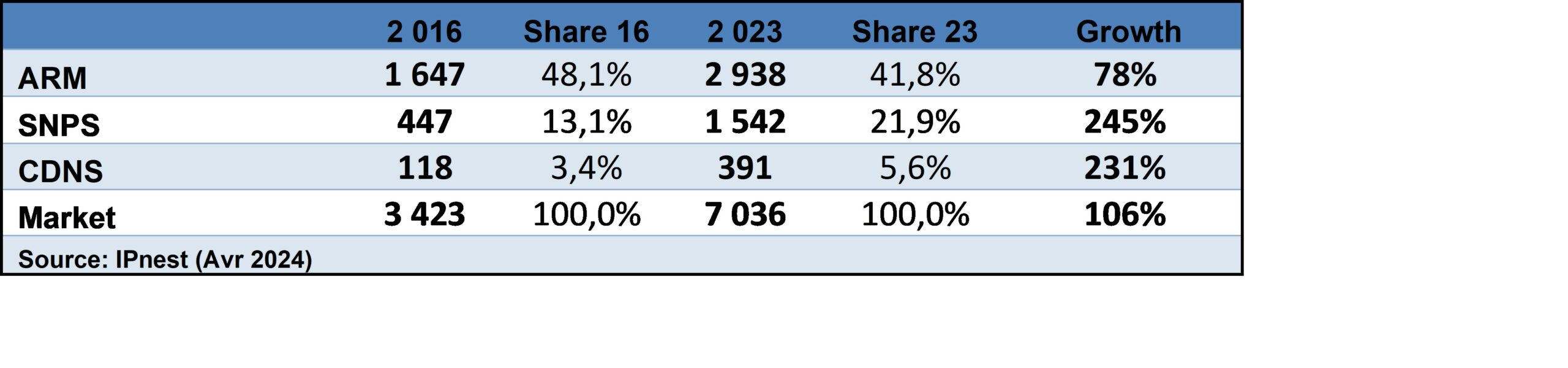

Between 2016 and 2023 the IP market has grown by 106%.

Between 2016 and 2023 the IP market has grown by 106%.

The Top 3 vendors have seen unequal growth. The No.1 compsny, ARM, grew by 78% when the #2 Synopsys grew by 245% and Cadence (#3) by 231%. ARM has gone from a 48.1% market share in 2016 to 41.8% in 2022.

Synopsys grew market share 13.1% to 22% 2016-23, and Cadence is went from 3.4% to 5.6%.

Respective 2016 to 2023 CAGRs are:

- ARM CAGR 8.6%

- Synopsys CAGR 19.4%

- Cadence CAGR 18.7%

When the global IP market has seen 2016 to 2022 CAGR of 10.8%.

The Wired Interface/Physical/Digital market share 2017 to 2023 shows interface category growth (18% to 28%) at the expense of the CPU/DSP/GPU market share which fell from 58% to 47%. Physical and Digital remained stable.

IPnest has also calculated IP vendors ranking by License IP revenues:

Synopsys is the clear No.1 by IP license revenues with 32% market share in 2023, when ARM is No.2 with 29%.

Alphawave, created in 2017, is now ranked No.4 just behind Cadence, showing how high performance SerDes IP is essential for modern data-centric application and can allow building performant interconnect IP portfolio supporting growth from 0 to over $200 million in 6 years… Reminder: “Don’t mess with SerDes!”

With 6% YoY growth in 2023 when the semiconductor market has declined by 8%, the Design IP industry is simply confirming how healthy is this niche within the semiconductor market and the 2016 to 2023 CAGR of 10.8% is a good metric.