In Parts 1 and 2 in our detective series of how Fastenal made the Big Pivot, I covered how the company achieved record-setting growth through a multi-sided transformation: reconfiguring their branch network by closing branches, growing onsite embedded branches and developing new sales strategies. This move to fewer branches shifted more resources on-site at end-customer locations (vending and Fastenal personnel on the plant or customer floor); smart sales realignment strategies were key pivot moves that delivered results. Here are the first two parts:

- Part 1: Branch Network Reset and the Rise of Integrated Supply

- Part 2: Sales Specialization & Realignment

In this analysis, we’ll cover the role that Fastenal’s other pivots across the dimensions of product, inventory and digital have played in its ten-year transformation journey: key investments and line expansions (manufacturing and refurbishing, private label, new product categories), inventory leverage as well as digital growth initiatives.

As any seasoned industry analyst knows, Fastenal – like many other publicly traded distributors – offers a wealth of investor presentations and materials that sheds light on their strategic direction, including digital transformation and the expansion of Fastenal product segments and capabilities. Let’s dig into some of the key factors of their 10-year growth formula.

Fastenal Product Strategy

A key pivot Fastenal made was to drive growth with product diversification. As the name implies, and as the company has referred to many times, “Fastenal started with a single fastener.” That core fastener business remains the foundation, but the company has broadened its product set significantly.

Fastenal was one of the leaders in what I call “Channel Drift” innovators. Today, for example, it is more common to see an electrical distributor that also sells HVACR and plumbing products (or has divisions serving multiple channels). Fastenal was one of the first channel drift leaders and has shifted from simply being a fastener provider. Its growth in MRO, facility, construction and safety products has been a major growth driver for the company.

That diversification approach has paid off, as the company stated in its most recent annual report: “In 1993, we began to aggressively add additional product lines, and these represented 66% of our consolidated sales in 2022.” The distributor’s fastener product line, which is primarily sold under the Fastenal product name, represented 34% of their consolidated sales in 2022.

That diversification approach has paid off, as the company stated in its most recent annual report: “In 1993, we began to aggressively add additional product lines, and these represented 66% of our consolidated sales in 2022.” The distributor’s fastener product line, which is primarily sold under the Fastenal product name, represented 34% of their consolidated sales in 2022.

Fastenal made safety products and solutions a big part of this product and solution diversification strategy.

I think Fastenal stated it well in that 2022 Annual Report: “The most significant category of non-fastener products is our safety supplies product line, which accounted for 20.8% of our consolidated sales in 2022. This product line has enjoyed dramatic sales growth in the last 10 years, which we believe is directly attributable to our success cross-selling safety supplies to customers that utilize us for non-safety products as well as our ability to market, deploy, and service industrial vending over that period.”

For comparison, in 2009, fastener sales comprised 50% of Fastenal sales, while safety products represented just 6.3%.

Private Label

Another key diversification pivot has been the company’s approach to private label brands. Fastenal added what they term “exclusive brands,” or brands sold exclusively through Fastenal, to its non-fastener offering. These private label brands represented approximately 13% of Fastenal consolidated sales in 2022, and approximately 20% of total non-fastener sales.

The company has also diversified through its products manufactured, modified or refurbished by Fastenal’s in-house manufacturing and industrial services divisions. Starting in 2019, this product modification, refurbishment and manufactured progress was highlighted as one of their three key “differentiators.”

The 2022 annual report stated that 410 million products were manufactured, modified or refurbished by Fastenal’s in-house manufacturing and industrial services divisions last year. That’s quite a jump from 290 million products just three years earlier in 2019.

This approach to adding value to products with modifications or refurbishments and manufacturing solutions for end customers is a significant widening of moats, in my opinion.

Inventory Strategy

Fastenal shared in 2022 that 58% of their then-$1.7 billion in inventory was staged locally for same-day fulfillment. This combination of inventory at a local branch or on-site in end customers’ facilities is hard to compare apples-to-apples with their publicly-traded peers like Grainger, MSC Industrial Supply and others. But the company has shared some details recently that paint a clearer picture.

In 2021, Fastenal published the following tidbit about its replenishment process:

“Our deployment of Local Inventory Fulfillment Terminals (LIFTs) shifts responsibility for the replenishment of FMI devices from our in-market locations to regional micro-hubs. This increases our selling energy, and ultimately labor productivity, by increasing the proportion of time our sales personnel spend selling vs. servicing. We also enjoy a boost to our asset efficiency by consolidating FMI-related inventory into fewer locations. When we achieve $10 billion in annual sales, we believe our FMI program will generate $6.5 billion in revenue and 40% of those FMI sales will be serviced by LIFTs.”

Here’s why I find this Onsite vending shift and the FMI-LIFTS projection interesting.

Fastenal currently lists 16 distribution centers in North America and Europe (12 U.S., 2 Canada, 1 Mexico and 1 Europe) that include very large DCs in California, Kansas City, North Carolina and Indianapolis. The Indianapolis DC is an estimated 1.08 million square feet with 547,000 tote locations. That scale makes it something I want to see.

Fastenal proudly shares that 90% of their product tonnage ships on Fastenal’s internal trucking fleet, helping to reduce cost and enhance service in 2022.

That combination of Fastenal’s own truck fleet and large DCs explains why I often see the company’s trucks when traveling U.S. roadways. All of these inventory disclosures paint a picture of putting the product as close to the customer as possible, ideally in Fastenal’s local branches the same day as orders are placed, and even more ideally, onsite at the customer’s location that same day.

Fastenal is decreasing its local counter and will-call sales every year by helping end customers become more efficient. It’s a winning customer self-service approach.

Digital Growth Strategy

When you think about self-service approaches, Fastenal’s digital strategy is obviously resonating with end customers.

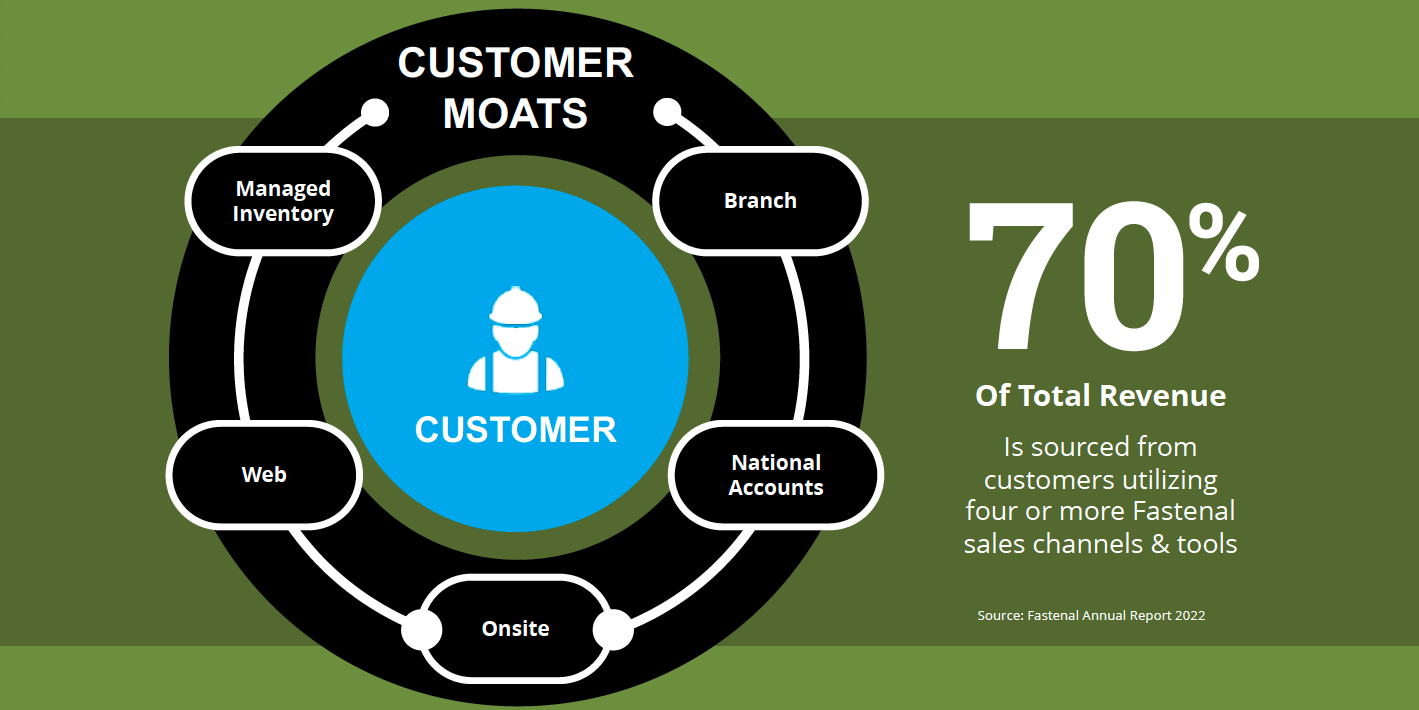

Fastenal reports that 93% of its current total revenue comes from customers using more than one of its sales channels and tools, with 70% of total revenue coming from customers using four or more. Sales channels and tools include branch, Onsite, Fastenal Managed Inventory (FMI), national accounts and eCommerce.

Additionally, 49% of total revenue comes from the company’s “digital footprint,” which is a combination of the company’s sales through FMI Technology (FASTStock, FASTBin and FASTVend), plus that portion of eCommerce sales that don’t represent billings of FMI services.

In 2021, Fastenal said they “accelerated the development and deployment of our FMI Technology…. As we look ahead, we believe our Digital Footprint will expand to approximately 85% of sales when we achieve $10 billion in annual revenue.”

In looking at those statistics, 70% of Fastenal’s total product and service portfolio has some significant moats around the business. For example, if you are a national account customer buying from a local Fastenal branch (the traditional distribution business model), your purchase is very likely touching at least two of the company’s channels between Onsite, FMI or eCommerce. Those three channels are often sticky customer services that build moats around their end customer business.

The Final Word

As I wrap this series, I’d like to share a few key takeaways. Fastenal has a clear strategy for growth and made some major pivots in the past decade. They moved from a traditional distributor approach where growth was driven by adding branches that stocked inventory near the customer, to a distributor model that is responding to the growing “self-service” end customer. As the customer has changed how they get product information, buy product and want it delivered, Fastenal has also adjusted.

The end customer is increasingly moving away from stopping into your branch for a counter order, drinking coffee and munching on popcorn while you fill the order. The future is likely a plant person going to get that same cup of coffee at their breakroom and picking up material from their distributor’s embedded vending machine on the way back to his or her workstation.

There is not a lot of mystery to “self-service” being the preferred solution for the typical Fastenal customer. If this were a game of Clue, the “self-service” customer is not just the suspect; it’s the golden goose that Fastenal strategically transformed its business model to cultivate and monetize.

So…Did it Work?

Throughout this three-part investigative case study, I’ve detailed these big three pivots Fastenal has made over the past decade. They beget the big question: Did they work?

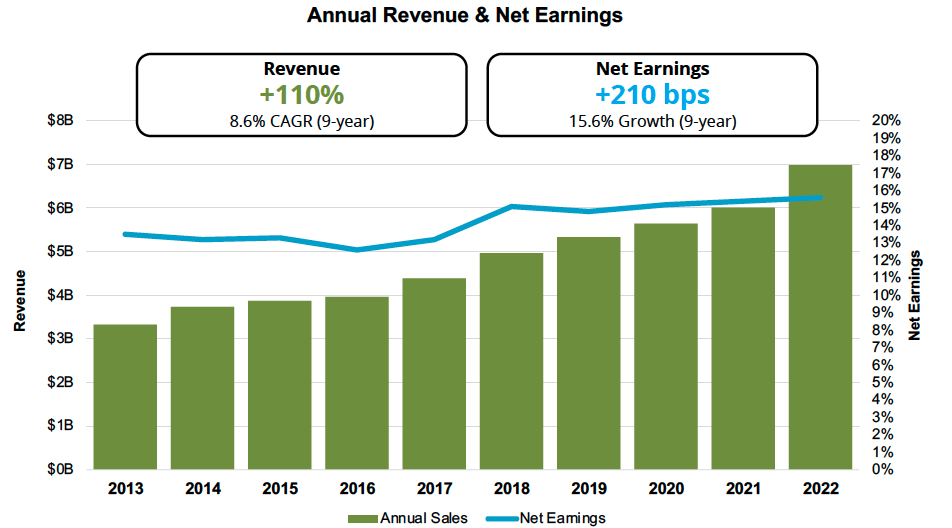

From 2013 to 2022, Fastenal sales grew 110%, and net earnings closed at 15.6%, up 210 bps from 13.5% in 2013. I’d say the pivots appear to have worked. It will be fascinating to see how the Fastenal story continues to evolve. I realize that its playbook simply can’t be copied by other distributors with the same results. Every distribution business and manufacturer are unique, but there are parts of the Fastenal story that might fit your market position to emulate and tweak to your business. I suggest you keep reading and following how the next chapter in their story unfolds.