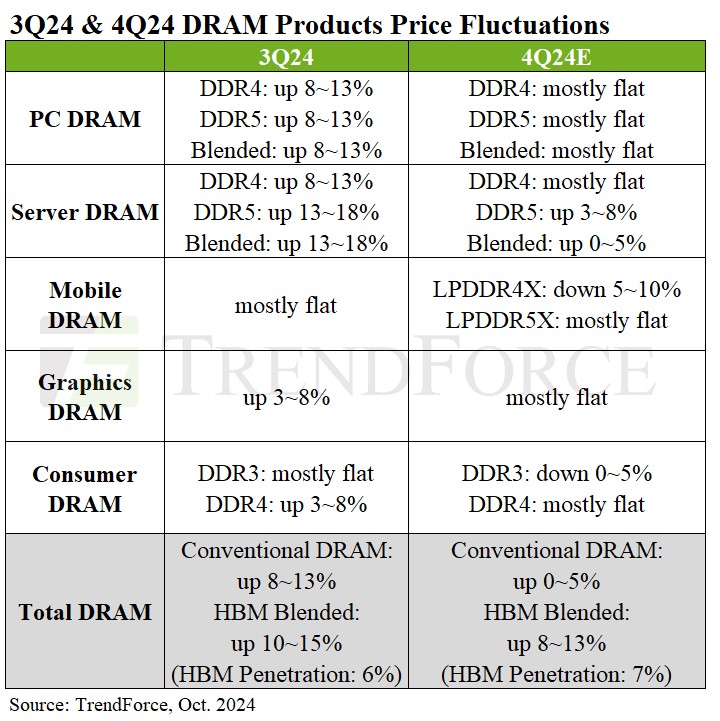

However, the rising share of HBM will increase the DRAM ASP by 8% to 13% which is a marked deceleration compared to the previous quarter.

PC sales have had a lacklustre Q3 and TrendForce anticipates that PC DRAM prices will remain flat compared to the previous quarter.

Server DRAM procurement was hit by US-based CSPs reducing orders due to high Q3 inventory levels. TrendForce reckons server DRAM bit shipments will improve in Q4, as DDR5 momentum improves and average contract prices rise by 0–5% QoQ.

Mobile DRAM Prices were hit by smarphone manufacturers focussing on inventory reduction in Q3 resulting in a 30% q-o-q drop in demand in Q3. TrendForce reveals that oversupply is becoming apparent because of the rapid capacity expansion of Chinese supplier CXMT in LPDDR4X, leading to an anticipated Q4 contract price decline of 5–10%. TrendForce expects Q4 LPDDR4X mobile DRAM prices to decline by 5-10% but LPDDR5X prices to remain stable

Graphics DRAM prices are projected to remain flat. Q4 demand remains lacklustre, with only a slight uptick in orders from VGA card manufacturers. Suppliers have eased their push for price hikes, while buyers continue to stockpile inventory, leading to stable prices through Q4.

Consumer DRAM demand remains weak. DDR3 prices may drop 0-5% because of oversupply but DDR4 prices are expected to remain stable. While DDR4 continues to be the mainstream consumer DRAM product, ongoing production increases from Chinese manufacturers, the possibility of a price drop cannot be ruled out.