In an unaudited pre-close Trading Update for the six months ended 30 June 2022, IQE says revenue for H1, is expected to be at least £85m (>7% growth) on a reported basis.

With a foreign exchange tailwind, this is in line with prior year revenue of £79.5m on a constant currency basis.

The Group’s view of the full year remains unchanged with previously issued guidance of low single digit % revenue growth in 2022 (at constant currency), with growth weighted towards H2.

The Group is focussing on executing the strategy of pursuing long term sustained growth through diversification and value creation.

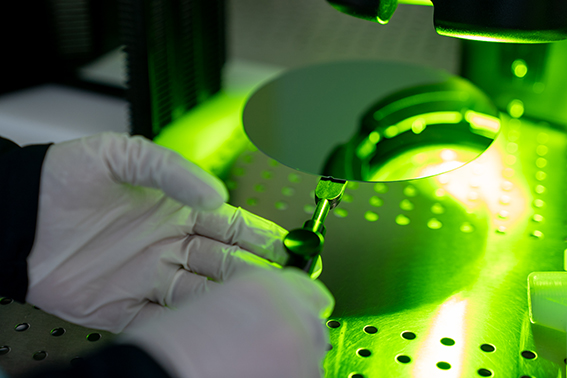

Milestones achieved in the first half of 2022 include the signing of a multi-year supply agreement with Lumentum, a strategic partnership agreement with Porotech, the announcement of the world’s first commercially available 200mm VCSEL and a commitment to Net Zero and Carbon Neutrality.

Further milestones are anticipated for H2 as the business is positioned for growth.

The Group will report full (unaudited) interim results on 6thSeptember 2022.

“I am pleased we have met our expectations and commitments for H1 2022,” says CEO Americo Lemos, “this year is about laying foundations for the healthy growth of the business, with a focus on a market approach while developing relationships with strategic customers to deliver long term growth and value to shareholders. We look forward to continuing with this momentum throughout the rest of the year.@

IQE supplies the whole market and is agnostic to the winners and losers at chip and OEM level. By leveraging the Group’s intellectual property portfolio including know-how and patents, it produces epitaxy wafers of superior quality, yield and unit economics.

IQE is headquartered in Cardiff UK, with c. 685 employees across nine manufacturing locations in the UK, US, Taiwan and Singapore, and is listed on the AIM Stock Exchange in London.