On Sept. 1, the Institute for Supply Management provided its monthly Manufacturing Purchasing Managers Index — widely looked to as a health barometer for the U.S. industrial sector — and the latest reading suggests factory activity held steady during August.

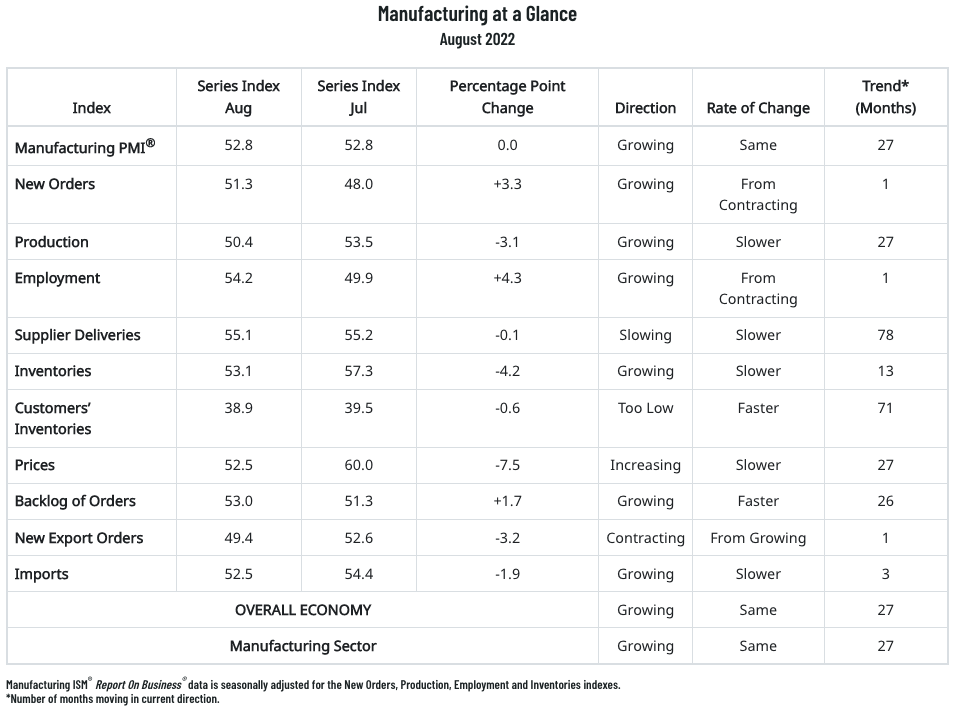

ISM’s latest PMI showed a reading of 52.8% — identical to July and down 0.2 percentage points from June. For the index, any reading above 50.0 indicates expansion. But while it was indeed the 27th straight month of expansion since contracting in April and May 2020 at the height of factory shutdowns from the COVID-19 pandemic, this summer’s readings have been down considerably from the marks of 56.1, 55.4 and 57.1 it had in May, April and March, respectively.

The August figure again tied again for the lowest PMI reading since June 2020’s 52.4.

Only three of the PMI’s 10 factoring indices grew in August compared to July: New orders returned to expansion territory, gaining 3.3 points to a mark of 51.3; and the index for Backlog of Orders grew 1.7 points to 53.0

Falling during August were: Production fell 3.1 points to 50.4; Supplier Deliveries dipped 0.1 points to 55.1; Inventories fell 4.2 points to 53.1; Customers’ Inventories dipped 0.6 points to 38.9; Prices sunk 7.5 points to 42.5; New Export Orders slid 3.2 points into contraction at 49.4; and Imports fell 1.9 points to 52.5.

“New order rates returned to expansion levels, supplier deliveries remain at appropriate tension levels and prices softened again, reflecting movement toward supply/demand balance,” commented Timothy Fiore, CPSM, C.P.M., chair of the ISM Manufacturing Business Survey Committee.

Fiore noted that August survey respondents’ commentary indicated that companies continued to hire at strong rates in August, with few indications of layoffs, hiring freezes or head-count reductions through attrition, while panelists reported lower rates of quits

“Prices expansion eased dramatically in August, which — when coupled with lead times easing — should bring buyers back into the market, improving new order levels,” Fiore added. “Sentiment remained optimistic regarding demand, with five positive growth comments for every cautious comment. Panelists continue to express unease about a softening economy, with 18 percent of comments noting concern about order book contraction. Twelve percent of panelists’ comments reflect growing worries about total supply chain inventory.”

View ISM’s August PMI chart below:

Related Posts

-

It was the slowest expansion since June 2020 as prices took a major month-to-month decline…

-

The representatives are in the Mid-Atlantic region and are expected to ‘promote and support’ the…

-

WESCO International announced the upcoming retirement of Ted Dosch, executive vice president, strategy and chief…