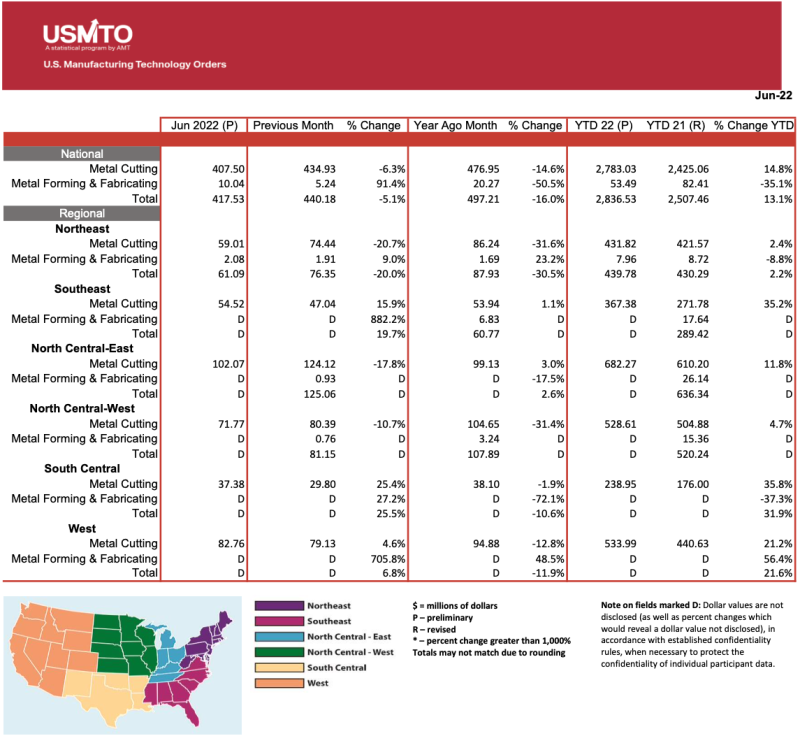

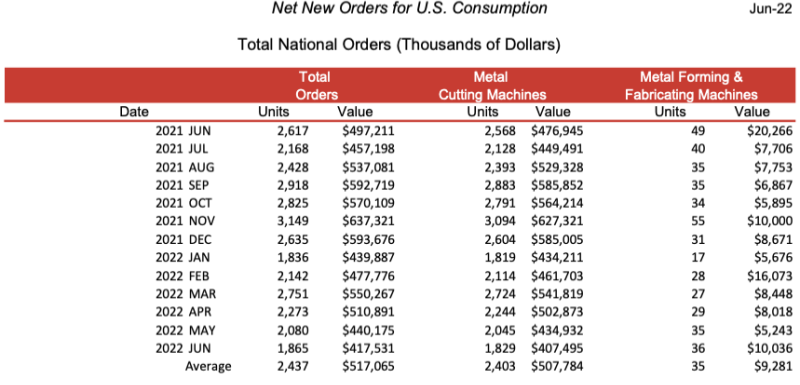

New orders of metalworking machinery totaled $417.5 million in June 2022, according to the Association for Manufacturing Technology’s June U.S. Manufacturing Technology Orders report, published Aug. 8. June orders of metal cutting machines and metal forming & fabrication machines were down 5% from May 2022 and declined 16% from June 2021, AMT’s data showed. However, through the first half of 2022, manufacturing technology orders have totaled $2.84 billion, a 13% increase over the first half of 2021.

“Being ahead of our best year on record to start 2022 is a good sign for the industry,” AMT president Douglas Woods said in a news release. “That said, we are beginning to see the normal trend of decreased orders through the summer months. IMTS is likely to reverse that trend. September orders in an IMTS year tend to exceed non-IMTS September orders by nearly $180 million. In addition to the immediate ‘September effect,’ orders following an IMTS tend to remain elevated for the remainder of the year.”

AMT noted that several other hurdles remain in the way of the industry matching the unbounded success of the last year. Supply chain issues continue to plague the industry, causing extended lead times for new equipment.

“Typically, shops with an order in hand need to begin making parts and may not be able to wait for new machinery to be delivered,” Woods said. “When making less-complex parts, some of the demand that would normally go toward new machinery is now being redirected to the used market.”

Despite these hurdles and an overall decrease in order activity, several industries are increasing orders, AMT noted.

“The manufacturers of construction machinery ordered the most new equipment since June of last year,” said Woods. “This is likely in anticipation of additional capacity needs to implement the infrastructure bill which became law last November.”

AMT noted that while the value of June 2022 orders was about 14% above that month’s average, the number of units were down by about 12% from a typical June.

“While some of this disparity is surely due to inflation, a much larger share is the addition of automation, which has become ever more necessary to keep production up as the labor market grows tighter,” Woods said. “Decreasing price points and increasing ease of use has accelerated automation adoption in industries that were typically hesitant to take the plunge. I am expecting to see many of these solutions on display Sept. 12-17 at IMTS in Chicago and expecting a large number of manufacturers to view them as well.”

See AMT’s latest market charts below, covering activity through the end of June 2022:

Related Posts

-

The association is scheduled to meet for the PTDA 2022 Canadian Conference in Montreal June…

-

The U.S. Census Bureau announced data for international trade, wholesale inventories and retail inventories advance…

-

Heating, Air-conditioning & Refrigeration Distributors International released its monthly TRENDS report reflecting the month of…