Alongside the NCAA basketball tournaments, there was a different form of March Madness this past month for wholesale distributors.

This past month saw a handful of large deals, including the announcement of the largest distributor transaction we’ve seen in at least a decade, and maybe ever.

That, of course, was The Home Depot stating March 28 that it plans to buy building materials supplier SRS Distribution for a whopping $18.25 billion — representing a 16x EBITDA 2023 multiple for SRS, which had $9.8 billion in 2023 revenue. It’s a blockbuster move that figures to gain Home Depot considerable pro contractor market share, and is the company’s strongest signal yet that it is all-in on expanding its pro offerings.

Stay tuned to MDM for further analysis of that historic deal, which is expected to close by the end of 2024.

But Home Depot-SRS wasn’t the only big deal announced or closed during March. Electrical distributors Border States and Sonepar broke news of deals that represent a combined $774 in added annual revenue. Border States is poised to acquire Dominion Electric Supply, which has nine locations across Virginia and Maryland, about 300 employees. Meanwhile, Sonepar will acquire Michigan-based distributors Madison Electric and Standard Electric — adding a combined 36 locations in the process.

Elsewhere, building materials distributor Gypsum Management & Supply closed on its previously-announced $321.5 million purchase of New York City-based Kamco, and London-based distribution group Diploma plc is set to acquire New-York based fasteners distributor Peerless Aerospace for $300 million. And on the manufacturer side, well known tool and metrology systems maker L.S. Starrett Company is going private in a $122 million acquisition.

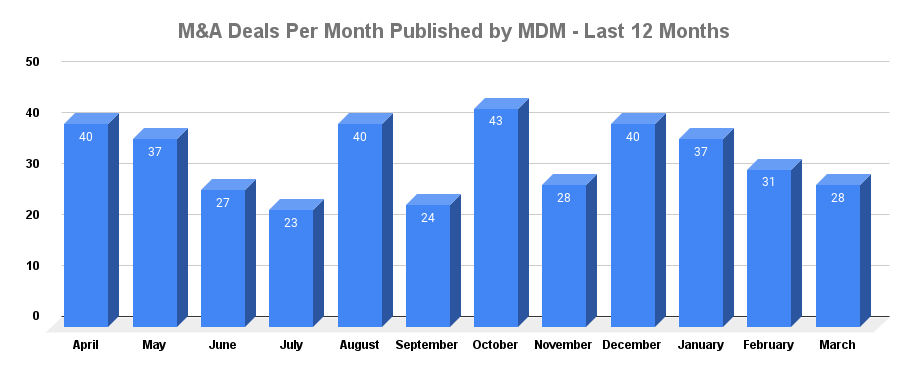

Those large deals resulted in a top-heavy March in which MDM covered 28 total news items of mergers and acquisitions involving distributors in the industrial, commercial and building supply markets, or manufacturers that sell into the channel. In terms of total activity, that figure was another deceleration from 31 in February, 37 in January and 40 in December, but still a healthy month by recent historical standards.Find our rundown of February M&A news below, mostly in reverse chronological order and separated by distributors and manufacturers.

Distributors (23)

ProSource Acquires Southern Distributing in S. Carolina: Greenville, SC-based plumbing and building supplies distributor ProSource added Lake City, SC-based Southern Distributing Co. — a supplier of plumbing and electrical supplies since 1972.

Home Depot to Acquire SRS Distribution for $18B in Building Materials Pro Shakeup: Set to close by the end of 2024, the deal figures to net The Home Depot significant expansion in the pro contractor market, as SRS’ 2023 revenue was $9.8 billion. SRS has about 760 branches across the U.S. and 10,800 employees. It represents Home Depot’s largest acquisition to-date.

U.K.’s Diploma to Buy NY’s Peerless Aerospace for $300M: London, U.K.-based distribution group Diploma plc is set to buy Farmingdale, NY-based fasteners distributor Peerless Aerospace, which supplies specialty fasteners into the U.S. and European aerospace markets.

House-Hasson to Acquire Bostwick-Braun’s Hardware Unit: Independent regional hardware distributor House-Hasson Hardware (Knoxville, TN) will acquire the wholesale hardware unit of Bostwick-Braun (Toledo, OH), which includes Southern Hardware Company. It essentially doubles House-Hassan’s warehouse footprint.

FleetPride Acquires Wheelco Truck & Trailer Parts in Sioux Falls: Aftermarket heavy-duty truck parts distributor FleetPride acquired the assets of Sioux Falls, SD-based Wheelco Truck & Trailer Parts and Service to add density to existing markets.

Border States to Gain Major Mid-Atlantic Foothold, Acquire Dominion Electric: The Fargo, ND-based electrical supplies distributor will acquire Dominion on May 1, pending regulatory approval. Established in 1940 and based in Arlington, VA, Dominion has over 300 employees and nine branches across Virginia and Maryland and had 2023 revenue of over $374 million.

Sonepar to Add Madison Electric and Standard Electric in Michigan: Electrical products distribution giant Sonepar is set to acquire Madison Electric Company and Standard Electric Company — two Michigan-based distributors that have a combined 36 locations across the state and approximately $400 million in 2023 revenue.

Fastener Industries Inc. Adds Die Co. in Ohio: Berea, OH-based Fastener Industries Inc. — the parent company of a group of employee-owned fastener distributors — added Die Co. Inc. as a wholly-owned subsidiary. Based in Eastlake, OH, Die Co. is a manufacturer of spring steel fasteners and metal stampings, serving distributors large and small.

Cameron Ashley Acquires Appalachian Insulation: Cameron Ashley continues its rapid expansion in the form of Elizabethtown, PA-based AIS and Wolf Pak Transport. Family-owned AIS distributes exclusively Johns Manville insulation, spray foam, mineral wool, sheathing and other insulation accessories to dealers and contractors.

Core & Main to Grow Geosynthetics, Acquire ACF West: Infrastructure supplies distributor Core & Main will grow its geosynthetics footprint across the western United States with the addition of NW Geosynthetics, doing business as ACF West.

Imperial Dade Acquires JAD Building Maintenance Supply in NYC: In its sixth acquisition of the year, foodservice packaging supplies, industrial products and janitorial supplies distributor Imperial Dade acquired JAD Building Maintenance Supplies, which serves the New York City metro area.

Spartan Tool Supply Privately Acquired in Ohio: PE firm Foundation Investment Partners acquired Columbus, OH-based industrial power tools and equipment distributor Spartan Tool Supply, which supplies commercial tools and equipment to businesses across various industries throughout Central Ohio.

AFC Industries Acquires Globe International Corp. in Philly: Continuing its rapid expansion, AFC adds Philadelphia-based Globe International Corporation — a distributor of fasteners, door hardware and galvanized aircraft cable that specializes in value-added kitting and other services. Globe maintains a distribution center in North Kansas City, MO.

With Acquisition, Distributor Shelton Machinery Forms Parent Firm: Following the acquisition of Municipal Tool & Machinery (Maryland Heights, MO), Indiana-based metalworking solutions distributor Shelton Machinery launched a new parent organization: TSM Group. Three machinery companies will now do business under their primary monikers and operate under TSM, including Shelton Machinery, Municipal Machinery and Concept Machinery.

Atlas Copco Acquires Air Compressor Distributor in Oregon: Sweden-based industrial equipment and tools maker and distributor Atlas Copco added Portland, OR-based compressor distributor Pacific Air Compressors, which has 15 employees.

GMS Completes Kamco Acquisition in NYC: Specialty building products distributor GMS completed its previously disclosed $321.5 million acquisition of New York City-based building materials distributor Kamco Supply Corp. Kamco had 2023 revenues of about $235 million.

US LBM Acquires Homestead Building Systems in Virginia: Specialty building materials distribution giant US LBM acquired Homestead Building Systems, a building component manufacturer based in Oranga, VA. HBS produces and distributes turkey structural building components from its distribution center in Bristow, VA.

Endries International Acquires Ace Bolt & Screw in Mississippi: Brillion, WI-based Endries gained a like fasteners distributor based in Jackson, MS. Ace has five locations in Mississippi and one in Georgia. It was Endries’ 12th acquisition since 2018 and the fifth since 2022.

Border States Acquires Winston Engineering, Adds Business Unit: In West Hollywood, CA-based Winston, electrical supplies distributor Border States gained a provider of mechanical, electrical and plumbing (MEP) engineering services. It enabled the company to launch Border States Engineering Services as a new business unit.

Cook & Boardman Acquires Lanmor Services: The Cook & Boardman Group (Winston-Salem, NC) — a provider of commercial entry solutions and systems integration services — acquired like distributor Lanmor Services, Inc. and Lanmor Services of Nevada. Based in Phoenix and Las Vegas, Lanmor provides commercial access solutions.

Imperial Dade Acquires Brawner Paper Co. in Houston: It added a 78-year-old paper and JanSan supplies distributor to Imperial Dade’s portfolio.

Graybar Acquires Blazer Electric Supply in Colorado: Electrical, industrial, communications and data networking products distributor Graybar acquired Colorado Springs, CO-based Blazer Electric Supply — an electrical distributor that serves construction, commercial, institutional and industrial customers out of two locations in southern Colorado.

Manufacturers (4)

Drilling Tools International Acquires Deep Casing Tools: Houston-based downhill drilling manufacturer Drilling Tools International Corp. acquired UK-based wellbore product engineer and manufacturer Deep Casing Tools to expand its presence both domestically and internationally and enhance its product offering.

Genesys Industries Acquires Latrobe Foundry: Genesys, a manufacturer of precision machined components for industry, added Latrobe Foundry Machine & Supply (Unity Township, PA), a 91-year-old manufacturer of threaded and flanged aluminum pipe fittings and hardware.

MiddleGround Taking Starrett Private in $122M Deal: Athol, MA-based L.S. Starrett Company, — a manufacturer of precision tools, cutting tools and metrology systems — will be acquired by an affiliate of private equity firm MiddleGround Capital, which will pay a 63% premium of Starrett’s March 8 closing stock price.

WALTER Expands in Robotics, Acquires PushCorp: Windsor, CT-based WALTER acquired PushCorp, Inc. — a Garland, TX-based robotic, material-removal, end-of-arm tooling, specializing in robotic force control, servo spindles and automation equipment.

Other (1)

Do it Best, United Hardware Set to Merge: Hardware, lumber and building materials buying cooperative Do it Best (Fort Wayne, IN) and wholesale hardware distributor United Hardware Distributing Co. (Maple Grove, MN) will combine to create a cooperative aimed to support the independent entrepreneur.

What’d We Miss?

Of course, the list above doesn’t encompass every M&A deal announced during March for relevant distributors and manufacturers. There will always be deals that weren’t on our radar. If you don’t see one here you think should be included, please let us know at editor@mdm.com.

- Here’s our February M&A Roundup

- Here’s our January M&A Roundup

- Here’s our 2023 M&A Recap (Premium)

- Here’s our December M&A Roundup

Related Posts

-

During the month, MDM reported on 43 mergers and acquisitions among distributors and manufacturers, the…

-

The University of Innovative Distribution educational program will be held on March 11-14, 2024, in…

-

Following a 36-year career with the company, François Anquetil will be succeeded by ex-Grainger veteran…