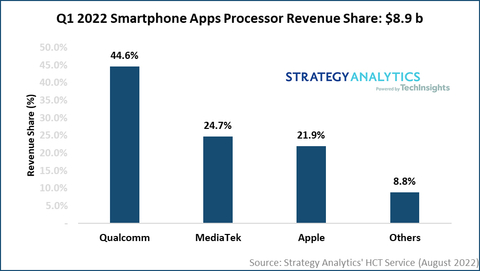

The report estimates that Qualcomm, MediaTek, Apple, Samsung LSI and Unisoc captured the top-five revenue share rankings in the AP market in Q1 2022.

- Qualcomm led the smartphone AP market with a 45% revenue share, followed by MediaTek with 25 percent and Apple with 22 percent.

- 5G-attached AP shipments accounted for 53% of total smartphone APs shipped in Q1 2022.

- Top-selling Android AI APs include Dimnesity 700, Snapdragon 778G, Snapdragon 8 Gen 1, Dimensity 810, Dimensity 900 and Snapdragon 888/888+.

- TSMC manufactured 80% of smartphone APs shipped in Q1 2022. Despite momentum with Snapdragon flagship chips, Samsung Foundry lost share due to weak Exynos shipments.

- Smartphone APs manufactured in 7 nm and below process nodes accounted for 48 percent of total smartphone AP shipments in Q1 2022.

- The low-end smartphone market demand is currently weak. We think inventory digestion will happen in 2H 2022 as vendors continue to destock their supplies.

- New entrants Google and JLQ Technologies (a JV of Leadcore and Qualcomm) together shipped less than a million APs in Q1 2022. On the other hand, HiSilicon’s shipments declined to near zero.

“Qualcomm’s 4 nm-based flagship AP Snapdragon 8 Gen 1 gained strong traction in Q1 2022,” says SA’s Sranan Kundojjala, “ the company’s increased share in Samsung’s Galaxy S devices drove its smartphone apps processor (AP) revenue to an all-time high. Qualcomm has been able to navigate China and macro concerns well with its premium and high-tier 5G APs, which are seeing high demand from Android smartphone manufacturers. Samsung’s Exynos AP shipments fell 40% in Q1 2022 due to increased competition from Qualcomm at Samsung Mobile. However, the company showed signs of recovery with mid-range APs such as Exynos 1280, featured in high-volume Galaxy A-series devices.”

Kundojjala continued, “MediaTek and Unisoc both posted an impressive performance in Q1 2022. MediaTek’s Dimensity 9000 premium tier AP was off to a promising start but shipments amounted to slightly less than 1 million during the quarter. However, the company’s increased focus on high-end could help it withstand weakness in the mid-range in 2022 and help it maintain ASPs. Unisoc, on the other hand, gained significant share in 4G APs, thanks to increased traction with tier-one design-wins.”