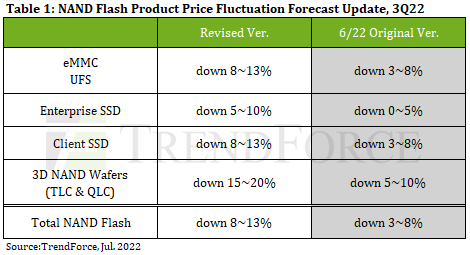

PC companies have reduced their purchase order volume in Q3 to digest H1 SSD inventory. 176-layer QLC SSDs have begun to ship, and YMTC looks to expand shipment of notebook client SSDs in H2. SSD pricing is expected to fall 8~13% in Q3.

Buyers of enterprise SSD are currently unwilling to expand procurement as server shipments disappoint – so Q3 enterprise SSD prices sre expected to decline 5~10%.

End customers and module customers for eMMC are focused on destocking due to the downward trend in demand. Over-supply in the eMMC market will become more serious than expected. Therefore, the Q3 price of eMMC will fall 8-13%.

With rising inventory pressure, reducing UFS prices to capture sales is inevitable. Q3 UFS pricing is expected to fall 8~13%.

With NAND manufacturers continuing to expand the supply of wafers, and with process optimisation continuing to improve, inventory pressure at factories is growing. The Q3 decline in NAND wafer pricing is expected to be 15~20%.