“After two consecutive years of steep declines that wiped out nearly $9 billion of RAN equipment revenues globally, it is encouraging that market conditions are now stabilising,” says Dell’Oro vp Stefan Pongratz, “at the same time, we should not get too excited and assume a swift recovery.”

RAN revenues, excluding services, are projected to grow at a -1 percent CAGR over the next five years, as rapidly declining LTE revenues will offset continued 5G investments.

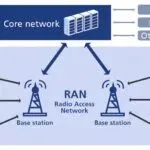

New technologies/architectures such as Open RAN, Cloud RAN, and AI RAN will play an important role going forward. But they are not expected to expand the RAN market.

New technologies/architectures such as Open RAN, Cloud RAN, and AI RAN will play an important role going forward. But they are not expected to expand the RAN market.

The flat baseline scenario implies upside risks if non-traditional RAN growth vehicles— including FWA, private wireless, public safety/mission critical, and MBB expansion to support changing end user requirements—accelerate the market more than expected.

As the investment focus gradually shifts from coverage to capacity, one of the most significant downward risks is slowing mobile data traffic growth. Should mobile data traffic growth decelerate more than anticipated, and operators transition into a maintenance mode following the completion of 5G coverage, capex-to-revenue could decline more sharply than currently projected.

5G-Advanced positions remain unchanged. The technology will play an essential role in the broader 5G journey. However, 5G-Advanced is not expected to fuel another major capex cycle. Instead, operators will gradually transition their spending from 5G towards 5G-Advanced within their confined capex budgets.

RAN segments that are expected to grow over the next five years include 5G NR, FWA, mmWave, Open RAN, vRAN, private wireless, small cells, Massive MIMO, and AI RAN