One thing distributors know definitively is customers care about price. As economic uncertainty hangs on in 2024, this is particularly true today.

After experiencing a series of price increases through the pandemic years 2020-2022, there is now little tolerance for across-the-board price jumps. To achieve growth and profitability goals, distributors are better served to instead focus on more strategic, long-term initiatives that benefit not only their bottom line, but that of their customers, too. One excellent example of this is a thoughtful rebate program that is fueled by insights on offering the right price at the right time.

When buyers agree to purchase a specific volume of product at a specific price, rebates can be used to reward them by giving them back a portion of the original purchase cost. Many distributors use them because they help promote customer loyalty, influence customer behavior, optimize purchasing and stocking activities and maximize margin.

But rebate management is also thought to be an administrative burden that, when not executed well, can create unintended margin leakage.

One-Size-Fits-All Rebates are Always Less Effective

To gain the full list of benefits, rebate programs require more complex administration than maintaining simple price list discounts. One of the foundational aspects is a heavy reliance on data and, more specifically, an understanding of the customers’ differing willingness to pay (WTP) thresholds.

As is with pricing, one-size-fits-all rebates may be easy to set up, but they are always less effective and leave money on the table. Linking customer WTP insights and rebates together is one of the most powerful profitability strategies distributors can implement.

A distribution customer’s WTP is the maximum amount of money they are willing to spend on a product or service. It represents the value that the customer perceives in an offering and is influenced by various factors like product features and quality, brand reputation, availability, alternatives available in the market and service and support.

Leaning into a shared data model, distributors can ensure hierarchies persist across initial list price setting, discounting and ongoing rebate management. This will ensure consistency and end-to-end visibility and it will power data-driven decision-making. From a rebate program definition to accrual generation, claim reconciliation and payouts, having a common data model across the commercial policies and definitions of customer, products and sales organizations is key to success.

With pricing and rebate system integration, you know the sensitivity customers have from gross to net prices and can combine different strategies to maximize profitability. This includes:

- Real-time response with dynamic pricing strategies that adjust rebate structures in real-time based on customer behavior and market conditions. This can help distributors capture more value from customers who are willing to pay while offering discounts to those who are more price-sensitive.

- Differentiation opportunities with a value-based pricing approach that helps align your rebate structures with your products’ perceived value.

- Collaboration across sales, channel, finance, and other relevant stakeholders by centralizing rebate program information and providing user-friendly interfaces for different stakeholders to access and contribute.

Structuring a Rebate Program

Armed with strategic pricing data, distributors can set up a rebate program with desired behavior(s) in mind. Consider defining a strategy and aligning clear objectives. Then, choose a rebate type for each customer segment according to the desired customer behavior.

Some things to keep in mind:

- Segment customers based on criteria such as class of trade, channel, buying behavior, geography or product preferences

- Analyze customer behaviors, preferences, and past purchase histories to identify patterns

- Tailor rebate structures to different groups and set the right rebate levels

Distributors can use rebates to cater to customer WTP and incentivize behaviors that align with business objectives. Offer discounts to customers who make larger purchases, buy bundled products or commit to long-term contracts, for example. High-value customers may receive more generous rebates, while price-sensitive customers might get smaller discounts.

Some customers might look for a tiered structure with increasing levels of discounts as they achieve higher purchase volumes, while others may want to maximize their rebate checks or their rebate programs’ year-over-year growth.

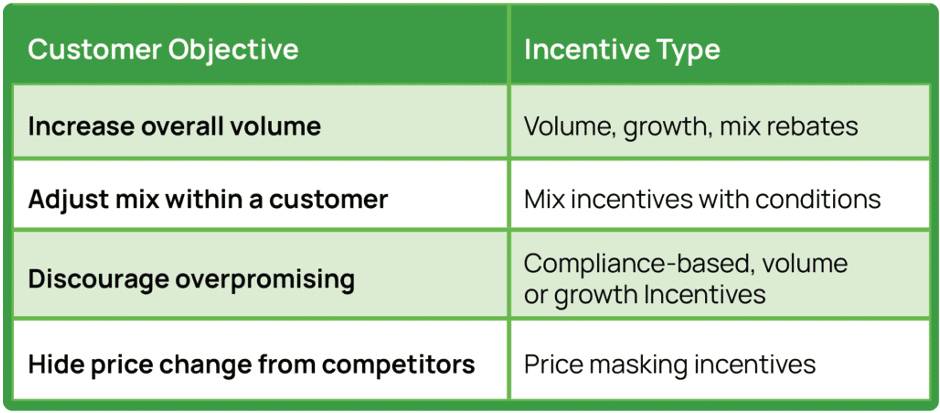

Segment your customers, set a desired behavior for each, and choose the appropriate rebate/incentive.

Tips for Successful Rebate Optimization

Creation of a set of segmented incentive templates will help reduce complexity and ensure the right incentive is applied to the right customer objective. This “rebates playbook” helps design incentives, set clear performance metrics, and maintain a commitment to transparency and improvement. Automation of both price setting and rebate management is another key success factor. Handling all the data behind WTP calculations and ongoing rebate management/optimization is rarely executed well manually. It leaves money on the table and interrupts prosperous channel relationships.

When distributors price their products, it’s important to remember not all customers are the same. The same is true when designing B2B rebates, incentives and loyalty programs. A thoughtful rebate program fueled by your customers’ WTP boosts the bottom line, encourages customer loyalty and improves channel relationships.