However, despite weak end markets, over-capacity and China’s potential to flood the market with mature product, Future Horizons sees the seedlings of growth in the non-AI, mainstream market with discretes, opto and analogue showing signs of recovery.

For this year, Future Horizons forecasts 16% growth to reach $732 billion with a worst case scenario of +15% and a best case scenario of +19% growth. For 2026, it sees 12% growth to reach $813 billion with a worst case scenario of 6% and the best case scenario of 18%.

The dichotomy in the market is the continuing red-hot AI datacentre boom, which is masking excessive capex while non-AI markets remain weak. “Nagging doubts are surfacing about the AI datacentre LLM bonanza and cracks are starting to surface in the insane levels of AI datacentre spend and an unclear ROI,” said Penn.

The July semiconductor unit shipment rate was on the long-term trend line, but this was because of pre-tariff ship-ahead orders, and there will be two more quarters before balance is restored.

Capex remains “stubbornly high“ at around 15% of sales as against the 11% long-term trend. However the culprit for that is mainly China.

In Q2 2025, sales revenue was up 22%, units were up 6.6% and capex was up 24%.“The capex growth should track the unit growth not the revenue growth!“ commented Penn.

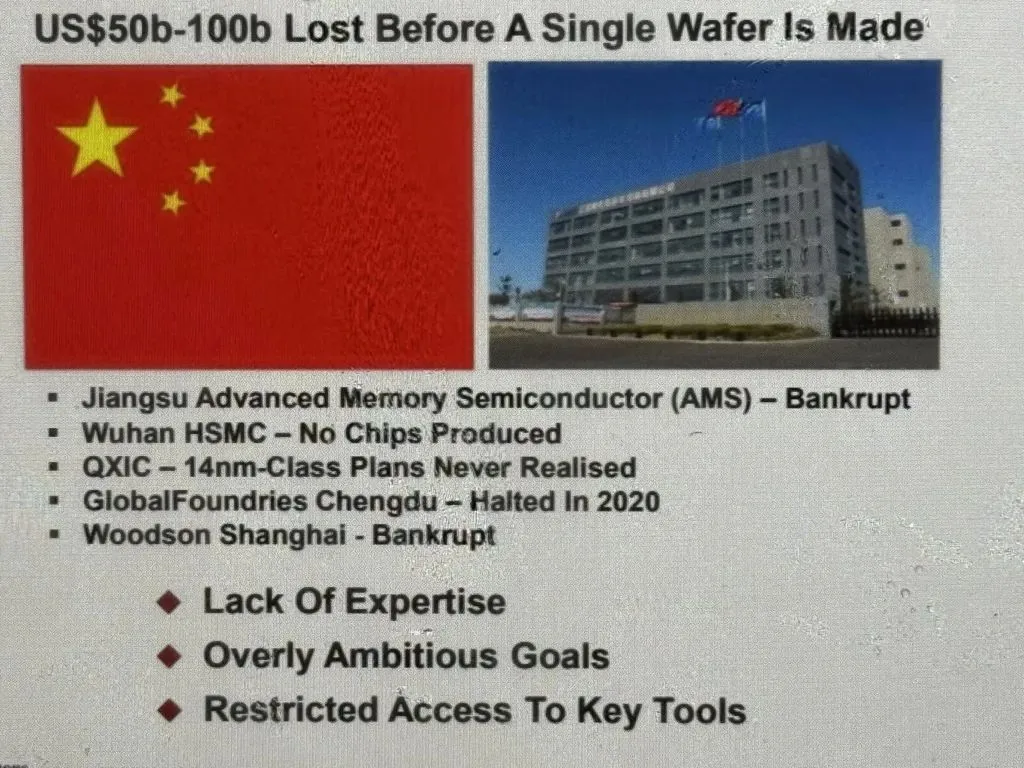

For China, turning capex into capacity has proved “challenging”, said Penn, with between $50 billion and $100 billion lost before a single wafer is made.

The ASP looks to have plateaued at July’s $1.76 after a low of $1.11 in June 2022.

The excitement over compound is evaporating. “There are no high volume niches in semiconductors,“ said Penn. China invested more in GaN fabs than in SiC, while TSMC has announced it is exiting GaN wafer processing by 2027 and Wolfspeed was the first of several SiC companies to face Chapter 11 bankruptcy.

AI is not the next disruptive innovation: “As we currently know it, it is just an improved Windows/Office/Google,” said Penn.