The US has already decreed in the Chips Act that companies taking money under the Act cannot make chips in China more advanced than 28nm for the next ten years – a provision which will affect both TSMC and Intel.

Similarly, the NAND flash limitation to 128 layers would hit foreign companies manufacturing in China as well as Chinese companies.

So it would apply, not only to Yangtze Memory but also to Samsung’s two Chinese NAND fabs and to the Intel fab which Hynix is in the process of buying.

Yangtze is by far the most successful of all China’s chip companies because it has a Taiwanese boss, Charles Kao, who had set up Nanya and recruited a top team of people who had set up memory businesses in the past and knew how to do it.

Yangtze is reported to have had government subsidies of $24 billion and its 2022 capex budget is said to be $32.8 billion.

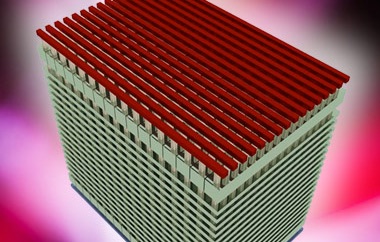

It has 5% of the flash market with 128-layer NAND taking 40% of its output and 64-layer representing 60%. Micron recently announced the most advanced NAND memory on the market – 232-layer.

Yangtze’s first fab was reported to have been running 100k wpm of NAND flash at the end of last year – at or near full capacity.

Yangtze’s Fab2, where equipment is currently being hooked up – is said to be capable of running 200k wpm and intended to increase Yangtze’s market share to 10%.