The market grew in each sequential quarter of 2024, including rising 4.8% between Q3 and Q4 and growing 5.8% between Q2 and Q3.

The latest Wi-Fi standards are driving growth in the enterprise WLAN market. Wi-Fi 6E, which enables Wi-Fi to utilize the 6GHz band of unlicensed spectrum, accounted for 31.9% of dependent access point market segment revenues in 1Q25, compared to 27.7% in Q1 2024.

Wi-Fi 7 adoption increased in Q1 too, making up 11.8% of the dependent AP segment’s revenues in 1Q25, growing from 10.2% of dependent AP revenues in 4Q24.

In the Americas, the enterprise WLAN market increased 15.2% year-over-year (YoY) in 1Q25, driven by strong growth of 21.0% in the United States.

In EMEA the market grew 11.0% YoY, while in the Asia Pacific region, revenues grew 1.0% YoY, as market revenues in the People’s Republic of China declined 4.2% YoY.

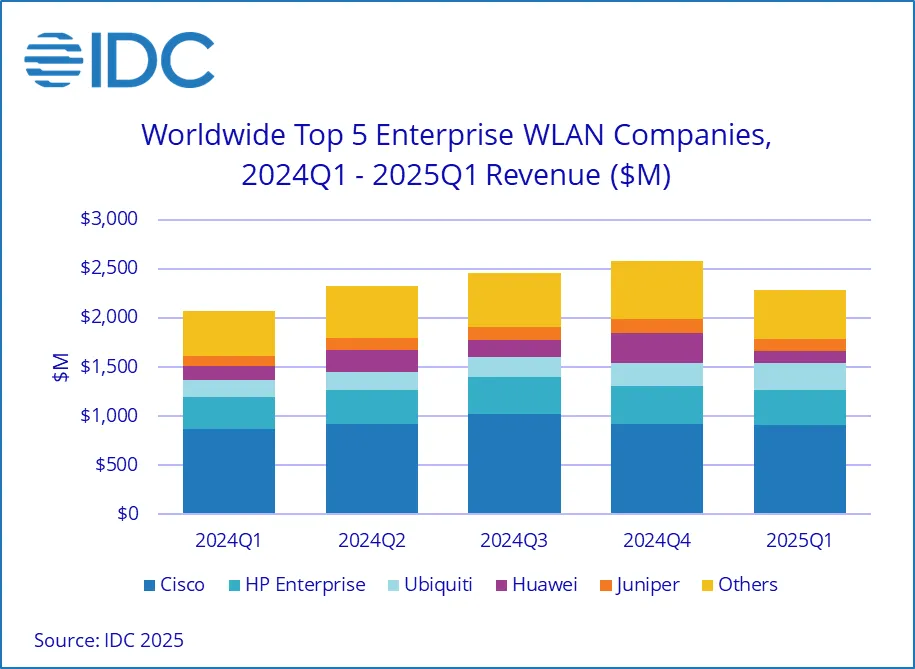

Cisco’s enterprise WLAN revenues rose 4.6% YoY in 1Q25 to reach $904.5 million, giving the company market share of 39.5%.

HPE Aruba Networking revenues grew 10.7% YoY in 1Q25 to reach $363.9 million, giving the company market share of 15.9%.

Ubiquiti enterprise WLAN revenues increased 50.9% YoY in 1Q25 to reach $267.4 million, giving the company market share of 11.7%.

Huawei enterprise WLAN revenues declined 10.7% YoY in 1Q25 to total $124.1 million, giving the company market share of 5.4%.

Juniper Networks’ enterprise WLAN revenues increased 21.9% YoY in 1Q25 to total $120.9 million, giving the company market share of 5.3%.